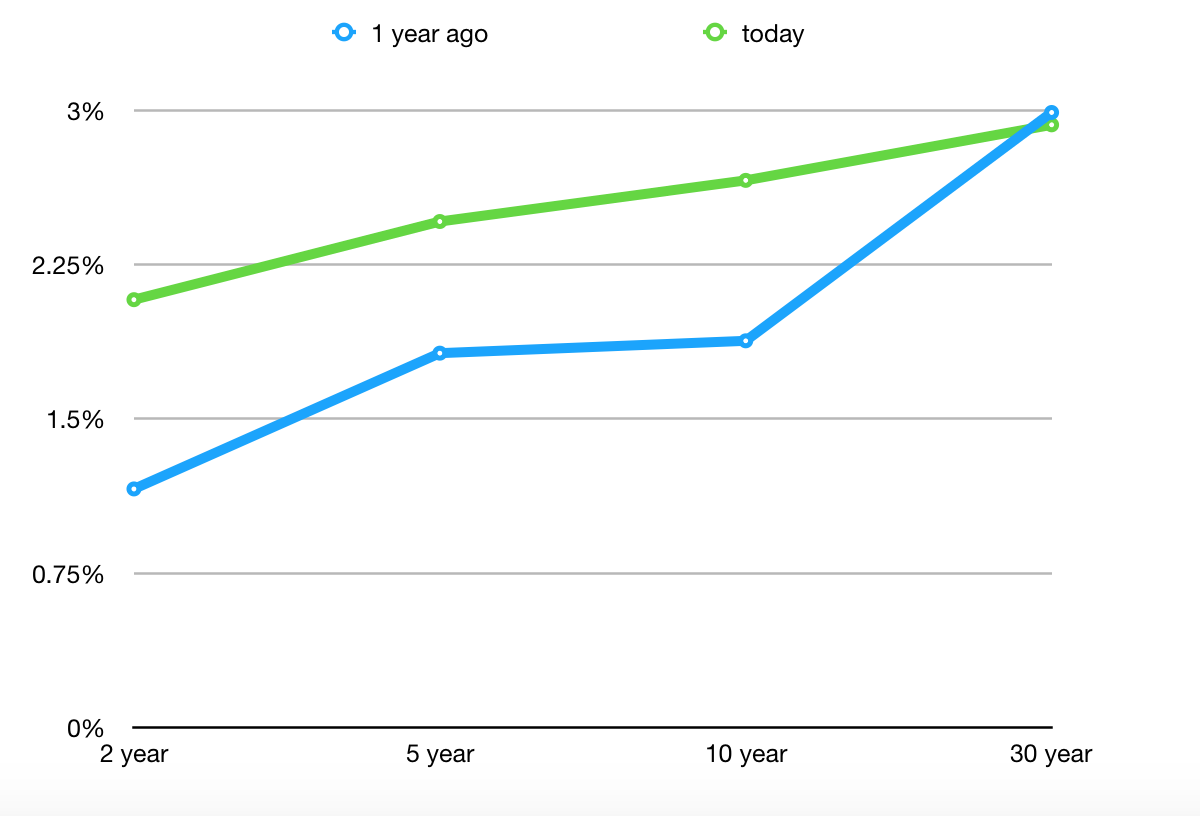

With stocks continuing to climb higher I’ve been a lot less active in terms of buying, especially on the Growth side of portfolios. However, there are some attractive opportunities popping up in the Income arena due to rising short and intermediate term bond yields. The yield curve is a line that measures yields at each…

When a Health Savings Account (HSA) is Right for You

Most of my posts are investment market related but I’m also an advisor who helps my clients with their financial planning. This post is more in that arena. With the annual “get screwed by health insurance season” right around the corner, I thought it would be useful to talk about HSA’s and whether or not…

A High-Yield REIT for Retirement Income Portfolios

A Real Estate Investment Trust (REIT) is a type of investment structure that allows investors to add exposure to real estate in their portfolio. REITs receive preferential tax treatment at the company level, where virtually all taxation is passed on to the investors, if they pay out at least 90% of net income as dividends. …

New “Income” Stock Investments

The move higher in bond yields since the election has slowly been creating some new opportunities in stocks that pay higher dividend yields. These types of stocks tend to be owned for the dividend income so they are usually more affected in the short-term by changes in the bond market (changes in relative yields) than…

A Simple Guide to Retirement

A few weeks ago I wrote a post on increasing your level of happiness and how achieving financial independence might just be the greatest source of happiness. Not because money makes you happy but because it can buy you the freedom from things that irritate you like work and its related stresses, commutes, financial stress,…

Investing, Life & Happiness

I love what I do but my job can often be pretty stressful and frustrating, especially in the upside-down world of central bank QE where investors have been rewarded for doing the exact opposite of what logic would dictate. For example, I’ve been openly critical on this blog of the long-term implications and distortions that…

How Systematic Investment Management Can Improve Returns

I made the decision this week to switch half of our Income Allocation within portfolios to a systematic management system. As I mentioned last week, I’m not totally sold that interest rates have bottomed but there’s a strong chance that they have, marking the end of the 35 year bull market in bonds. If rates…

Adapting Our Approach Toward Growth

Just about all of my clients are long-term, retirement oriented investors. The most frustrating thing the past few years for long-term investors is how the central banks have largely “killed” the markets in the traditional investment sense. What I mean by “killed” is that I cannot honestly consider bonds yielding less than 2% and stocks…