After a long hiatus from the blog, I’m back! I never really went anywhere. Things were so hectic in March and April that I was focusing all of my time on staying on top of everything. After that, I was using direct communication to keep my clients updated and since then I just haven’t had…

Market Risk is Highest Since 2007/08

I’m going to try to keep this post a little shorter by not getting too deep into the explanations but I wanted to post an update with my thoughts based on what I’m seeing. Given the weakening economic backdrop, the risk across the board is probably at its highest point right now since 2007/08. The…

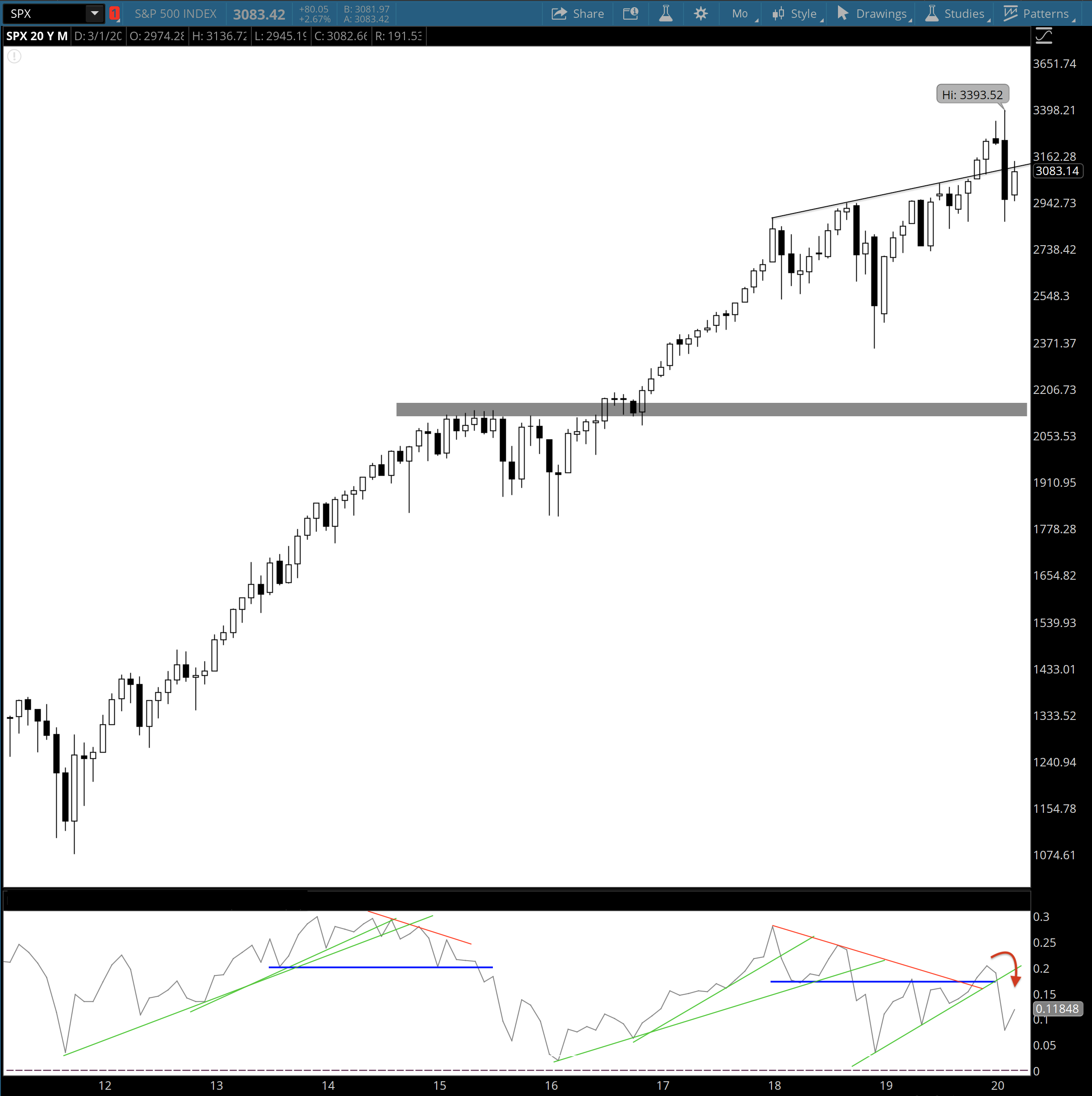

On the Verge of a Recession & the Most Important Chart Right Now (Feb 2020)

Unfortunately the employment numbers lately have been disappointing and the job openings number this morning was very worrying, down 14% on a year-over-year basis. Initial and Continuing Unemployment claims have also been rising on a year-over-year basis. So we have unemployment starting to tick higher and hiring slowing – two things seen at the…

Some New Investments (January, 2020)

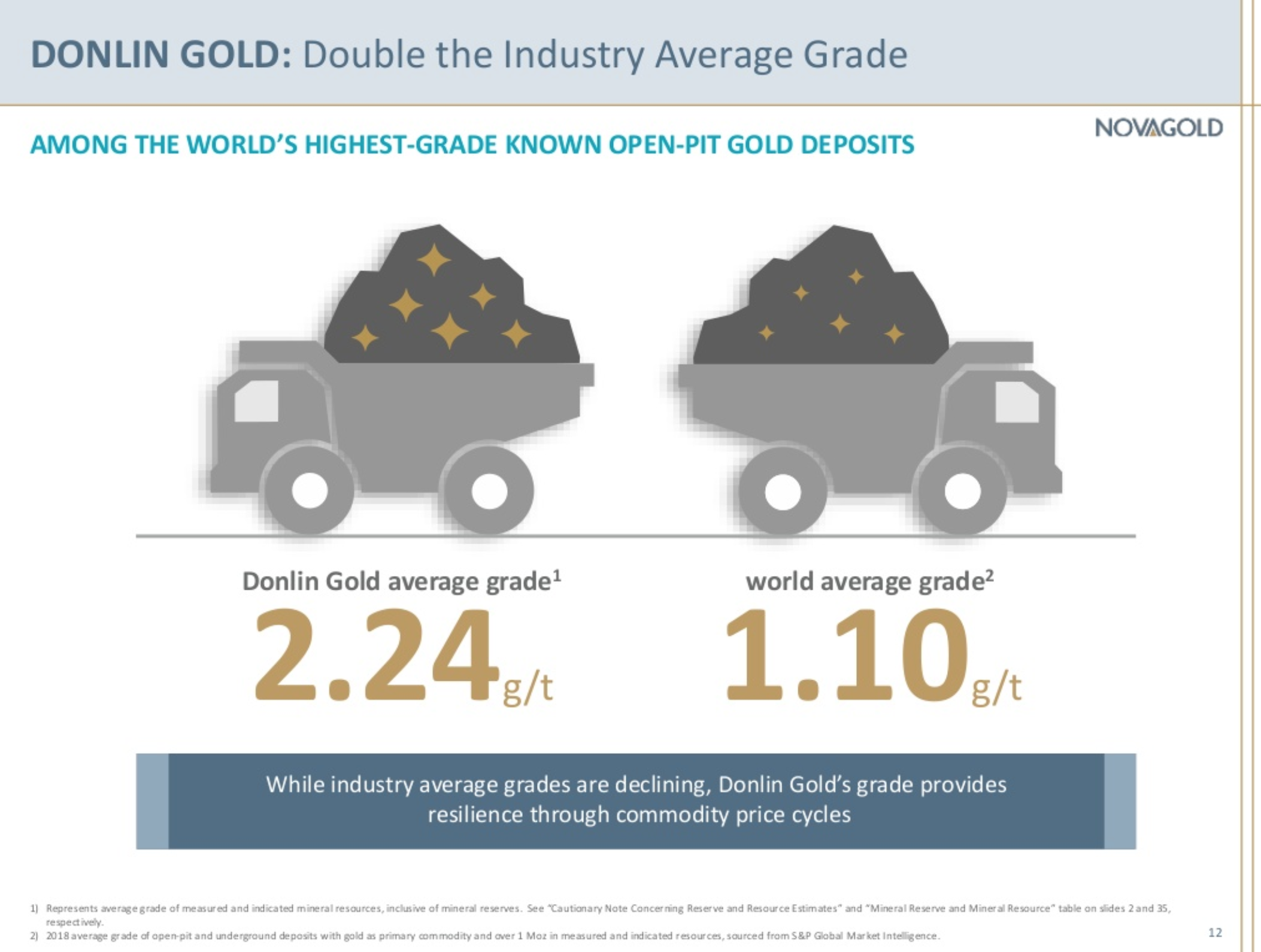

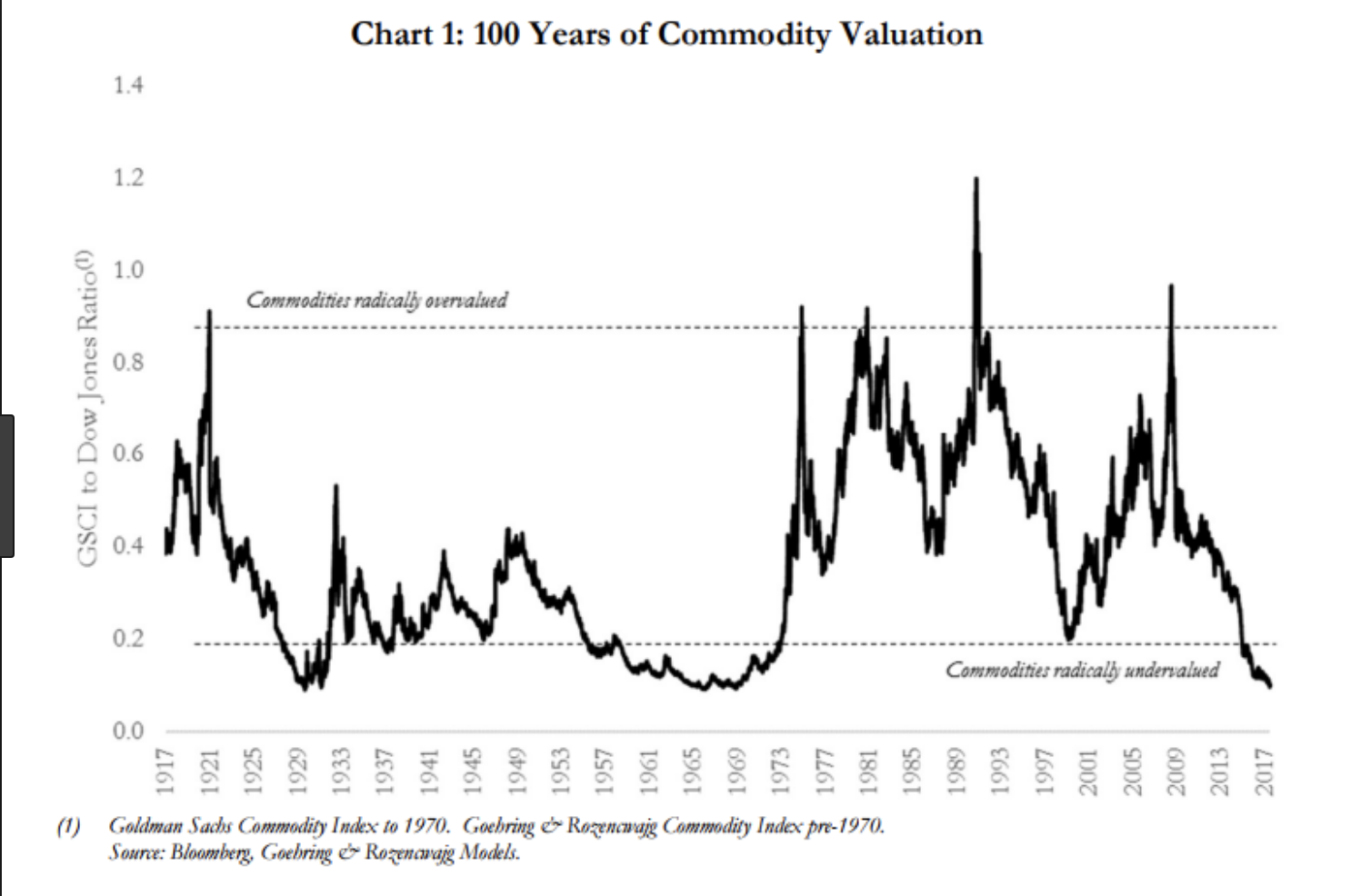

I’ve made 3 new investments over the last month or so for clients, all of which are Growth holdings. Two companies are junior gold miners and the third is a long-term compounder. Commodities are a tough business to operate in because companies don’t have control over the final selling price of the product which…

Approaching a Critical Juncture

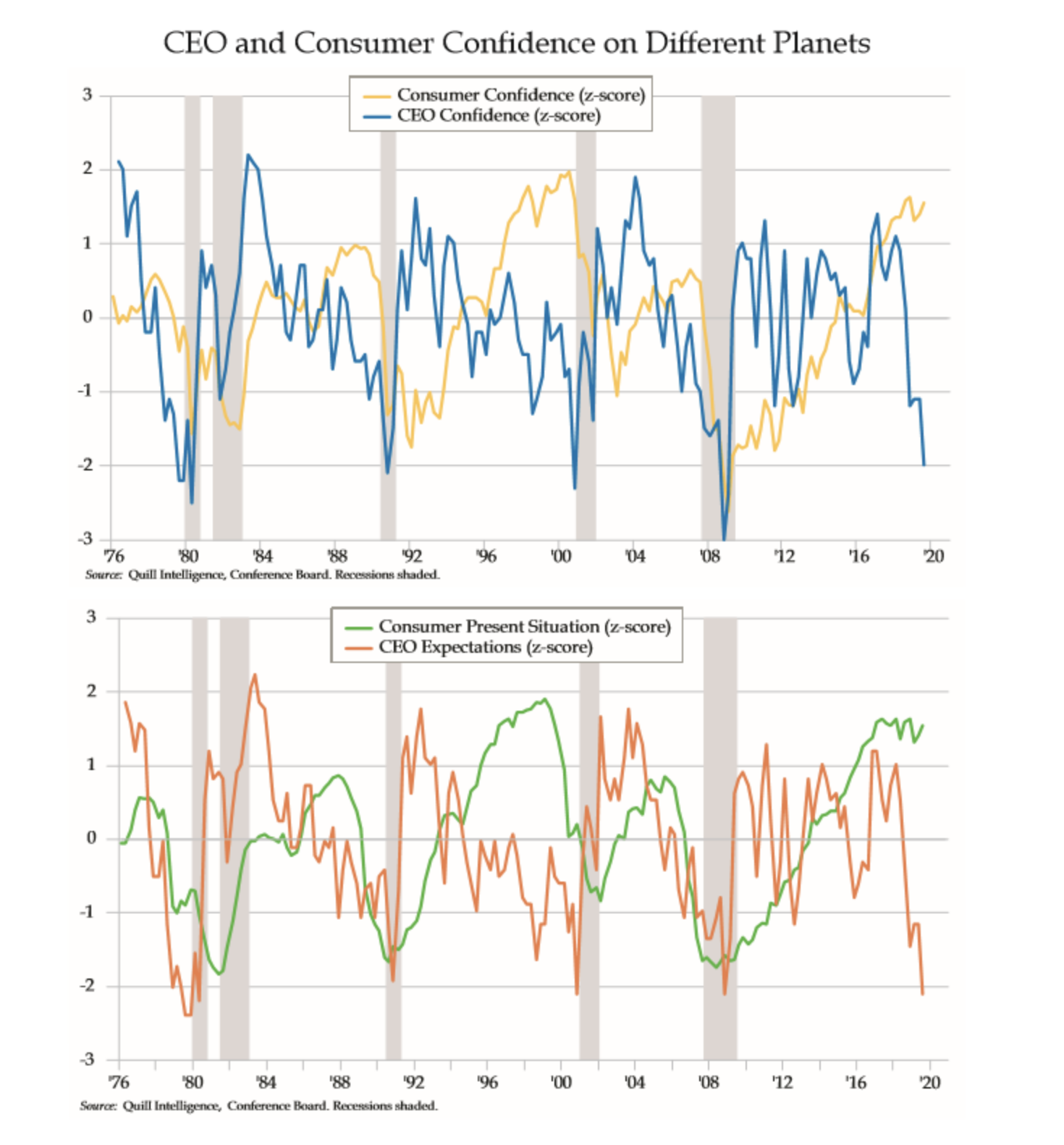

I continue to see classic signs of late cycle behavior. Late cycle doesn’t mean that it’s over today, and I still haven’t seen the deterioration in credit or stock markets to turn me bearish yet, but it does suggest caution and not being overexposed to risk. Danielle DiMartino Booth, a former advisor within the…

Things That Have Caught My Eye Lately – Sept, 2019

This post will be an all encompassing update of things that have caught my eye over the past month. The ECB, the IMF & Christine Lagarde Christine Lagarde, the head of the IMF, was selected to be the next president of the European Central Bank (ECB) and secured the backing of the European Parliament…

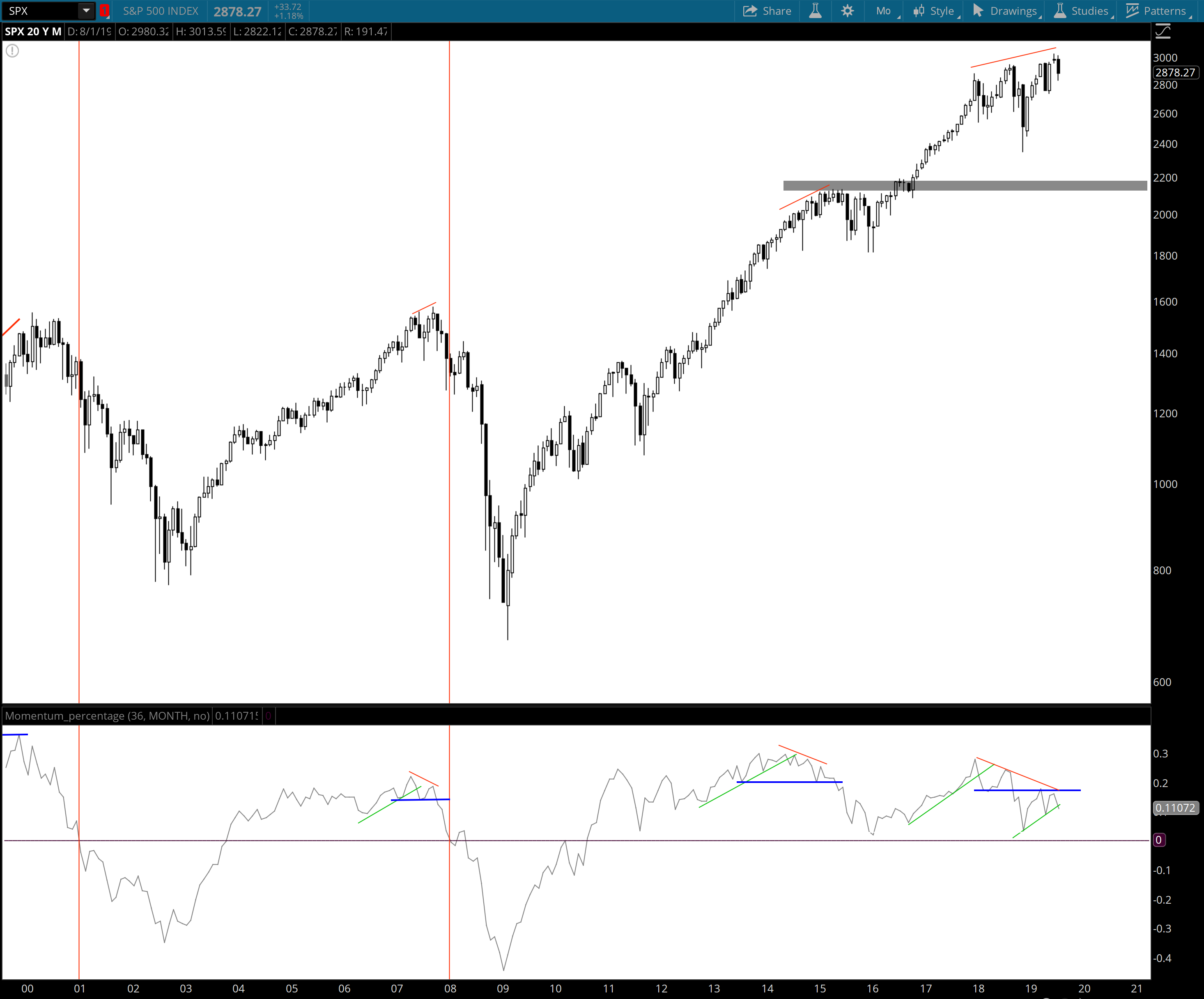

Markets & Macro Update – Aug 6th, 2019

Last week the Fed cuts interest rates for the first time since the GFC a decade ago and the market’s response was pretty interesting. After referencing the 1995/96 one-and-done cut that prolonged the 90’s expansion all summer, I think they were hoping that they could get away with one cut as “insurance” that would ease…

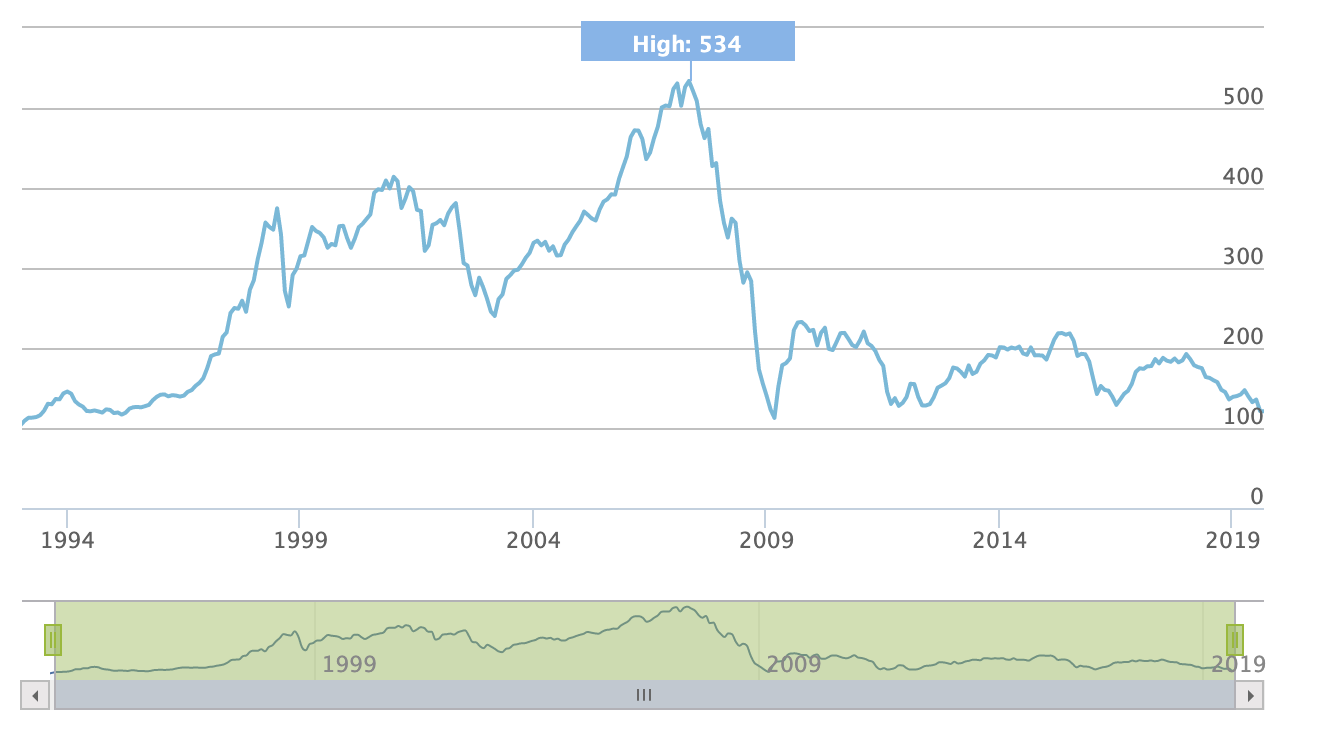

It’s All Connected – Why Gold is Starting to Shine

If you don’t own gold, you know neither history nor economics. -Ray Dalio I haven’t written anything in a little while because, well, there hasn’t been a whole lot going on to write about. We have had the usual Fed go full-panic-dove-mode, we’ve reportedly made progress on a trade deal with China about 28 times…