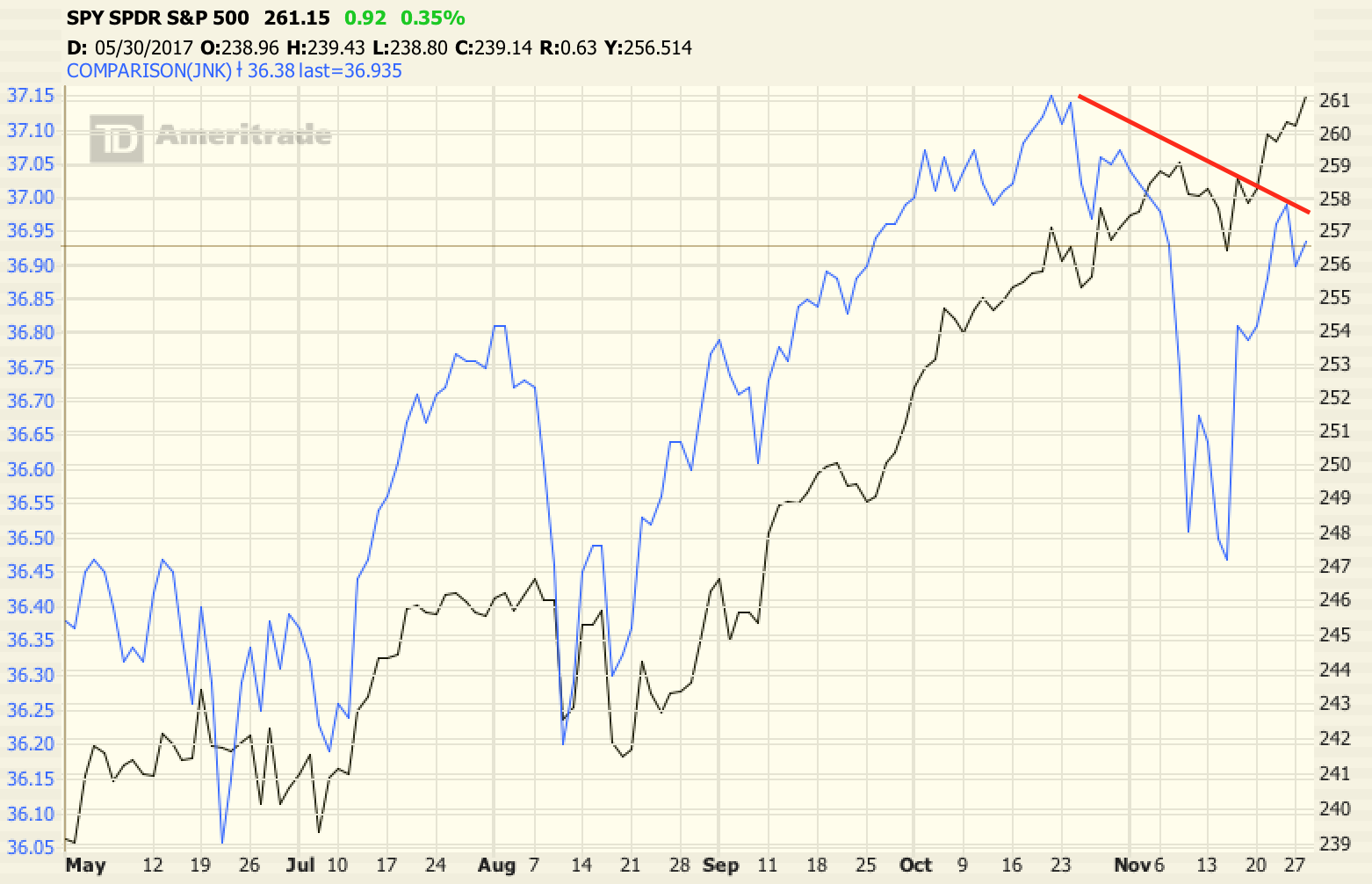

As I’ve commented on a few times this summer, rising interest rates and a flatter yield curve have been applying pressure on the economy. One area in particular that has seen a fairly strong slowing is the housing market, with home builders and related housing stocks down significantly from their highs earlier this year. I…

Portfolio Updates: 2 New Buys, 1 Sale

Here are some portfolio changes from last week. New Investment: Walgreens Boots Alliance (WBA) We purchased stock in Walgreens last week. Concerns that Amazon is expanding into drug distribution with their purchase of Pillpack earlier this summer knocked the stock down to a pretty attractive valuation. I think this is a massive overreaction similar to…

Recent Updates – Insurance, Biotechs, Dividends and Rates

Here are some recent updates from this month, including some new investments and some thoughts on how the market is setting up in terms of the economic outlook, interest rates and higher yielding (dividend) stocks. New Investment – Chubb Limited (CB) Insurance is an interesting industry in which to invest. When run properly, it can…

Yields & Income Investment Updates

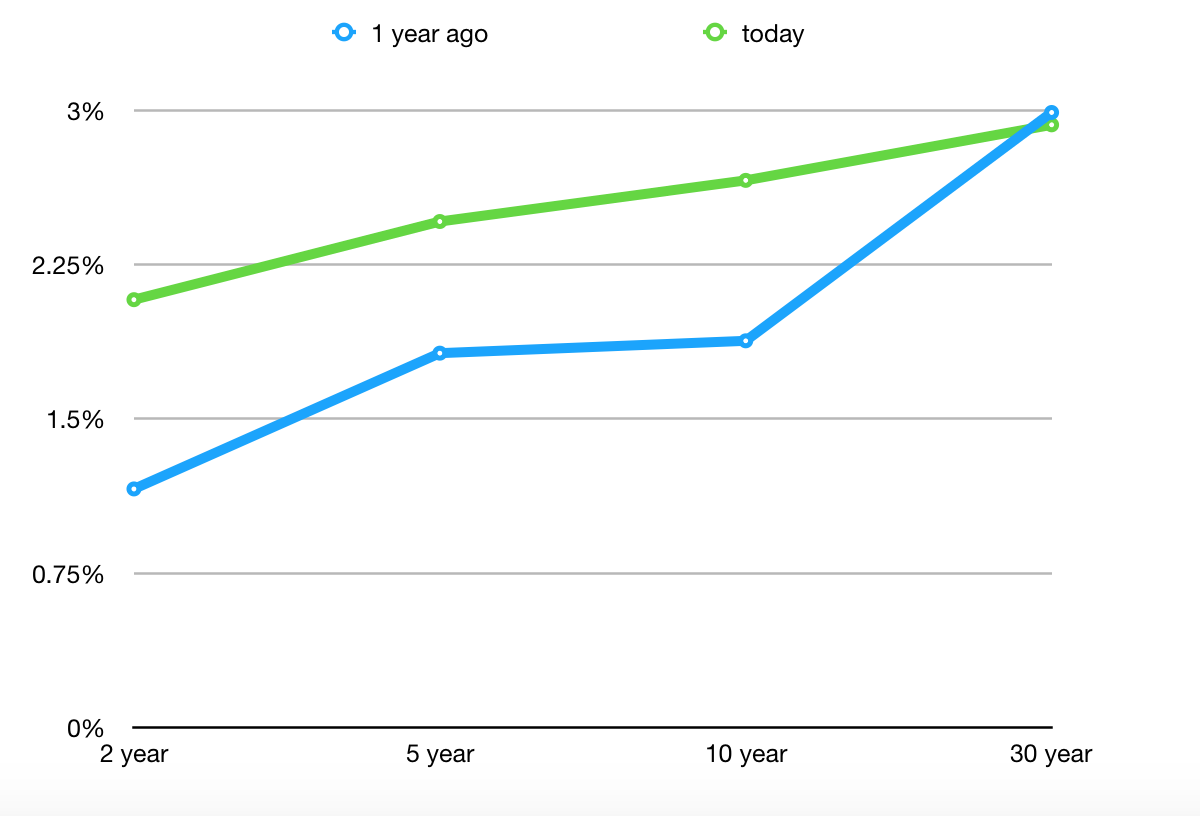

The 10-year Treasury yield stopped just short of 3% last week and the recent Commitment of Trader’s data is showing massive short exposure to the 10-year futures contract by non-commercial traders. These are speculative positions betting that the 10-year yield will continue to rise (bond prices will continue to fall). The market has a funny…

Starbucks, Dividends and the Power of Compounding

I purchased stock in Starbucks (SBUX) last week when the stock was trading down about 5% following an earnings release that fell short of analyst expectations. I love it when short-term momentum traders bail on a great long-term story, creating an opportunity for us to buy. After an over 2 year hiatus, we’re back to…

Rising Yields are Creating an Opportunity for Income Focused Investors

With stocks continuing to climb higher I’ve been a lot less active in terms of buying, especially on the Growth side of portfolios. However, there are some attractive opportunities popping up in the Income arena due to rising short and intermediate term bond yields. The yield curve is a line that measures yields at each…

GE, a Lesson on the Perils of Debt and the Current Market Environment

GE, Debt and Dividends A few weeks ago General Electric (GE) announced that they were cutting their dividend in half in order to preserve cash flow. The last two times GE cuts it dividend were 1929 and 2008. That says something about the state of the economy. The stock market is by no means a…

Highlighting Some New Investments

Here’s a brief overview of some recent investments made over the past few weeks. TripAdvisor (TRIP) We purchased stock in TripAdvisor as a growth investment. This is a unique stock that has tremendous long-term growth potential if management can execute. I’m sure almost everyone is familiar with TripAdvisor. They run a site where users can…