Here are some recent updates from this month, including some new investments and some thoughts on how the market is setting up in terms of the economic outlook, interest rates and higher yielding (dividend) stocks. New Investment – Chubb Limited (CB) Insurance is an interesting industry in which to invest. When run properly, it can…

Starbucks, Dividends and the Power of Compounding

I purchased stock in Starbucks (SBUX) last week when the stock was trading down about 5% following an earnings release that fell short of analyst expectations. I love it when short-term momentum traders bail on a great long-term story, creating an opportunity for us to buy. After an over 2 year hiatus, we’re back to…

GE, a Lesson on the Perils of Debt and the Current Market Environment

GE, Debt and Dividends A few weeks ago General Electric (GE) announced that they were cutting their dividend in half in order to preserve cash flow. The last two times GE cuts it dividend were 1929 and 2008. That says something about the state of the economy. The stock market is by no means a…

Highlighting Some New Investments

Here’s a brief overview of some recent investments made over the past few weeks. TripAdvisor (TRIP) We purchased stock in TripAdvisor as a growth investment. This is a unique stock that has tremendous long-term growth potential if management can execute. I’m sure almost everyone is familiar with TripAdvisor. They run a site where users can…

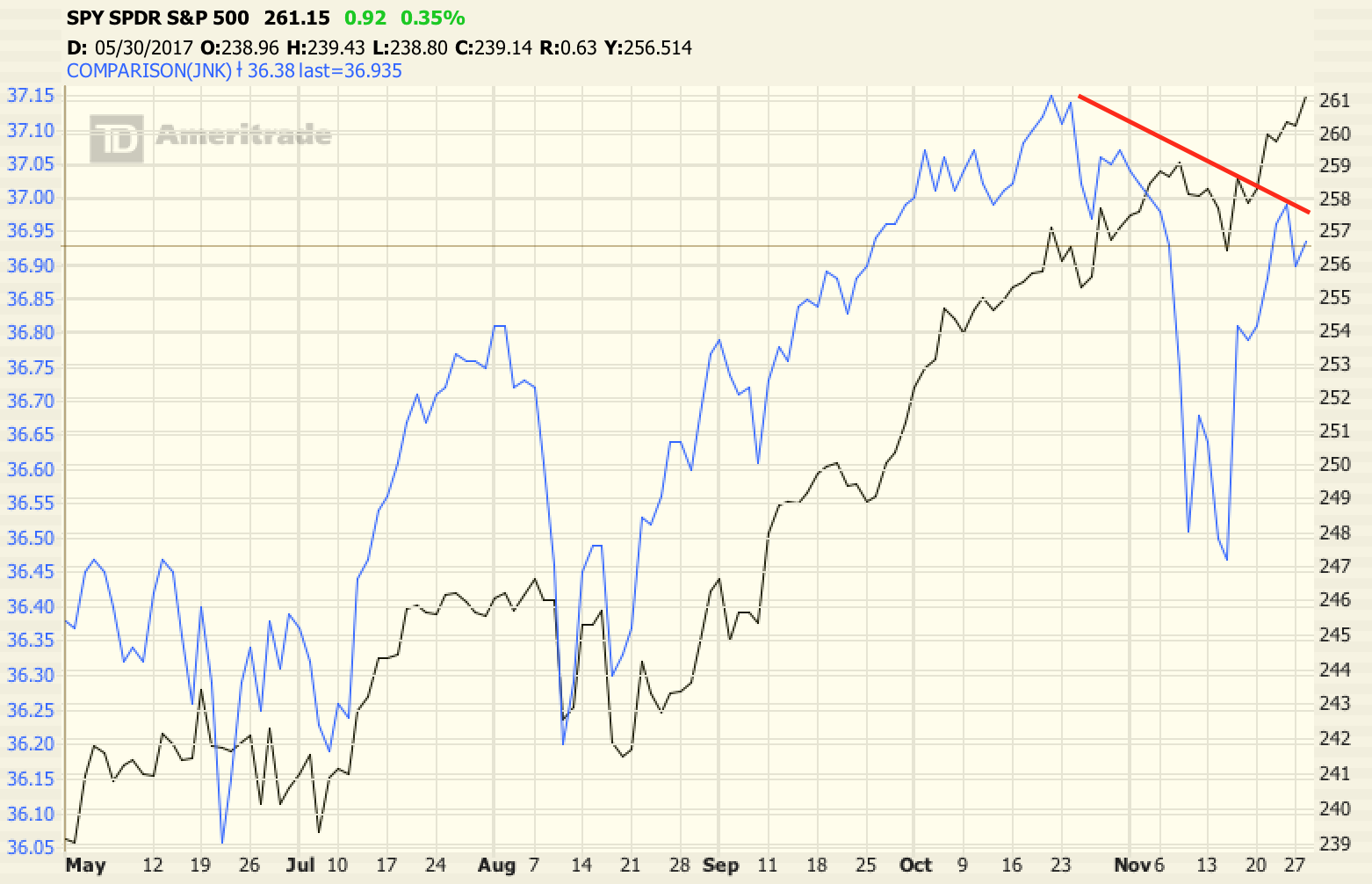

Chart of the Week: Stocks as Bond Proxies

This week’s chart comes from yours truly. For much of the year, and especially so since Treasury yields broke to new lows after the Brexit vote, the “safe” high yielding stocks like Utilities, Consumer Staples and Telecom have been tracking daily changes in the bond market – not the stock market. If bond yields move…

“Safe” Stocks Not Looking So Safe Anymore

“Rule No.1: Never lose money. Rule No.2: Never forget rule No.1” -Warren Buffett The most important part of investing is to avoid losses. This is why I so often use this blog to talk about the risks I’m seeing. If you can avoid the landmines and diversify among the rest, you’ll do pretty well. What…

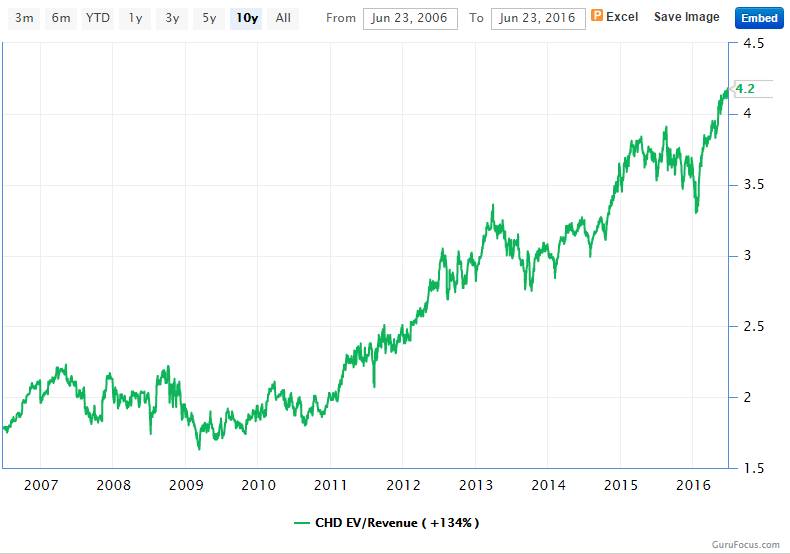

Why Investing in Food Makes Sense for Retirees

I’ve been thinking a lot lately about the types of investments that offer the best risk adjusted returns in this environment. One of the toughest things to evaluate today, and perhaps the most important when investing in stocks, is the sustainability of a company’s business model, cash flows and profits. Technology continues to change things…

Say Hello to Your New “Synthetic” Corporate Bonds

Investors have been “starved” for yield for years now and unfortunately interest rates aren’t going up anytime soon. When looking at individual bonds, investors get to choose between high quality bonds at paltry yields or junk-rated bonds that look attractive but come with a slew of bad risks that often aren’t understood or appropriate for…