Is this recent volatility in the stock market bothering you? I have a simple solution for you. Just stop looking at it! One of the most common traits that the vast majority of us share is that a loss of something hurts more than the equivalent gain (in our case it will be money). This…

2 Different Ways to Invest for Growth

I generally look at Growth investments in one of two ways: either steady compounders or huge reward-to-risk, asymmetric growth opportunities. The steady compounders are the companies that can consistently post growth year after year in a secular manner – secular meaning a long-term story not affected by short-term cycles. Whereas the high growth opportunities tend…

Recent Portfolio Updates

European Stocks European stocks and US stocks typically move with a fairly high correlation but they’ve diverged quite a bit over the past 3 years as both the euro currency and British pound have depreciated significantly against the US dollar. I’m thinking we’ll likely see this gap close over the next year so I started…

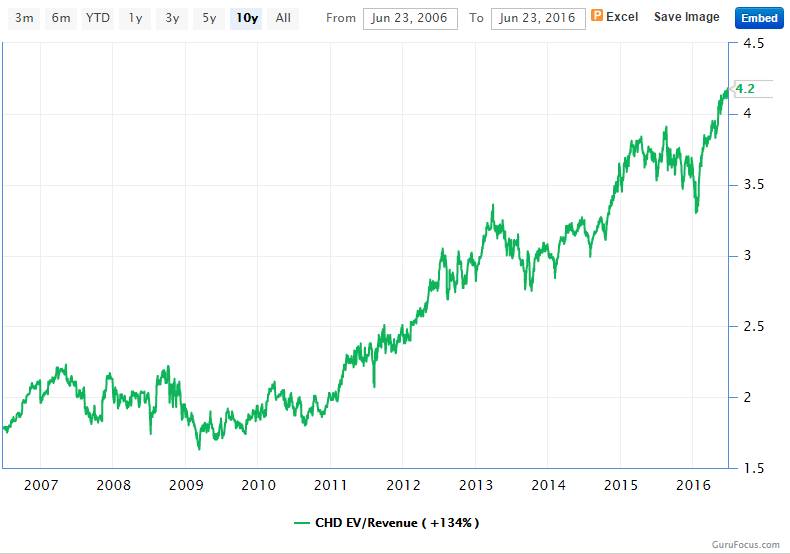

“Safe” Stocks Not Looking So Safe Anymore

“Rule No.1: Never lose money. Rule No.2: Never forget rule No.1” -Warren Buffett The most important part of investing is to avoid losses. This is why I so often use this blog to talk about the risks I’m seeing. If you can avoid the landmines and diversify among the rest, you’ll do pretty well. What…

Earnings Updates

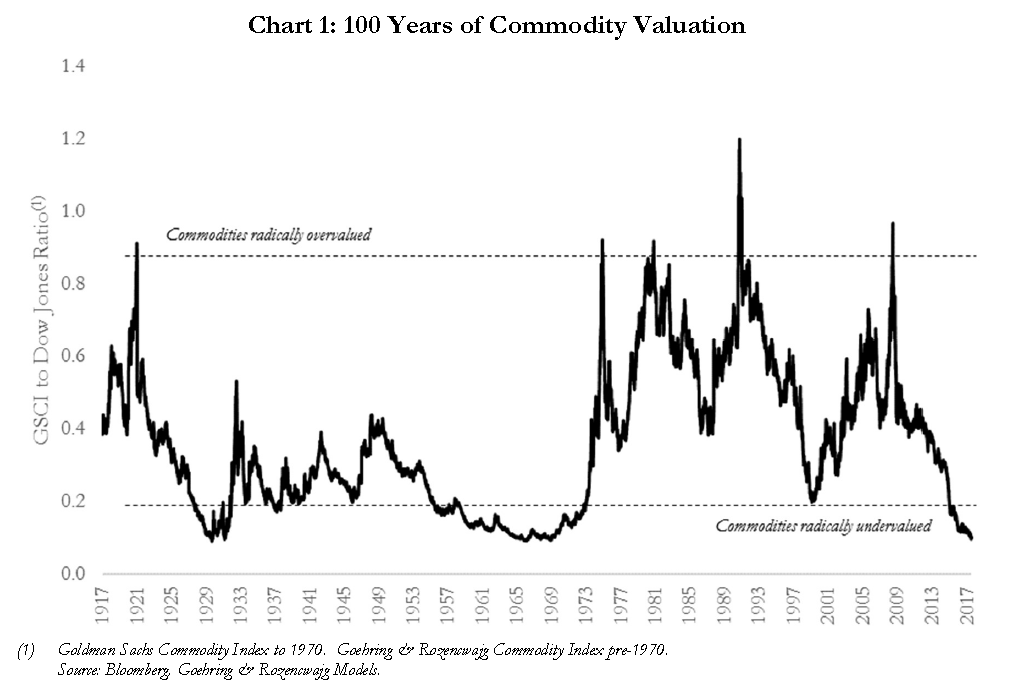

Once again, I’ve been very pleased with the earnings and outlook reported by the majority of the companies we own. A few of our core holdings held their conference calls this morning so I wanted to provide a quick update. CF Industries (CF) & Terra Nitrogen (TNH) CF is our largest “Growth” holding and TNH…

Why I’m revamping our “Income” Holdings

I’ve been reworking the stock holdings within the income allocation of portfolios all year. To offer some background, I break portfolio allocations into two segments, Growth and Income, and fit clients based on the amount of volatility that’s appropriate for their retirement/financial plan. These days, “Income” oriented investments don’t offer much in the way of…