Macro changes occur at a glacial speed but these are typically the most important metrics to track. This is separating the signal (macro shifts, leading data points, etc.) from the noise (CNBC). Warning Signals from the Yield Curve One of the most basic yet crucial metrics is the yield curve, which has certainly received a…

GE, a Lesson on the Perils of Debt and the Current Market Environment

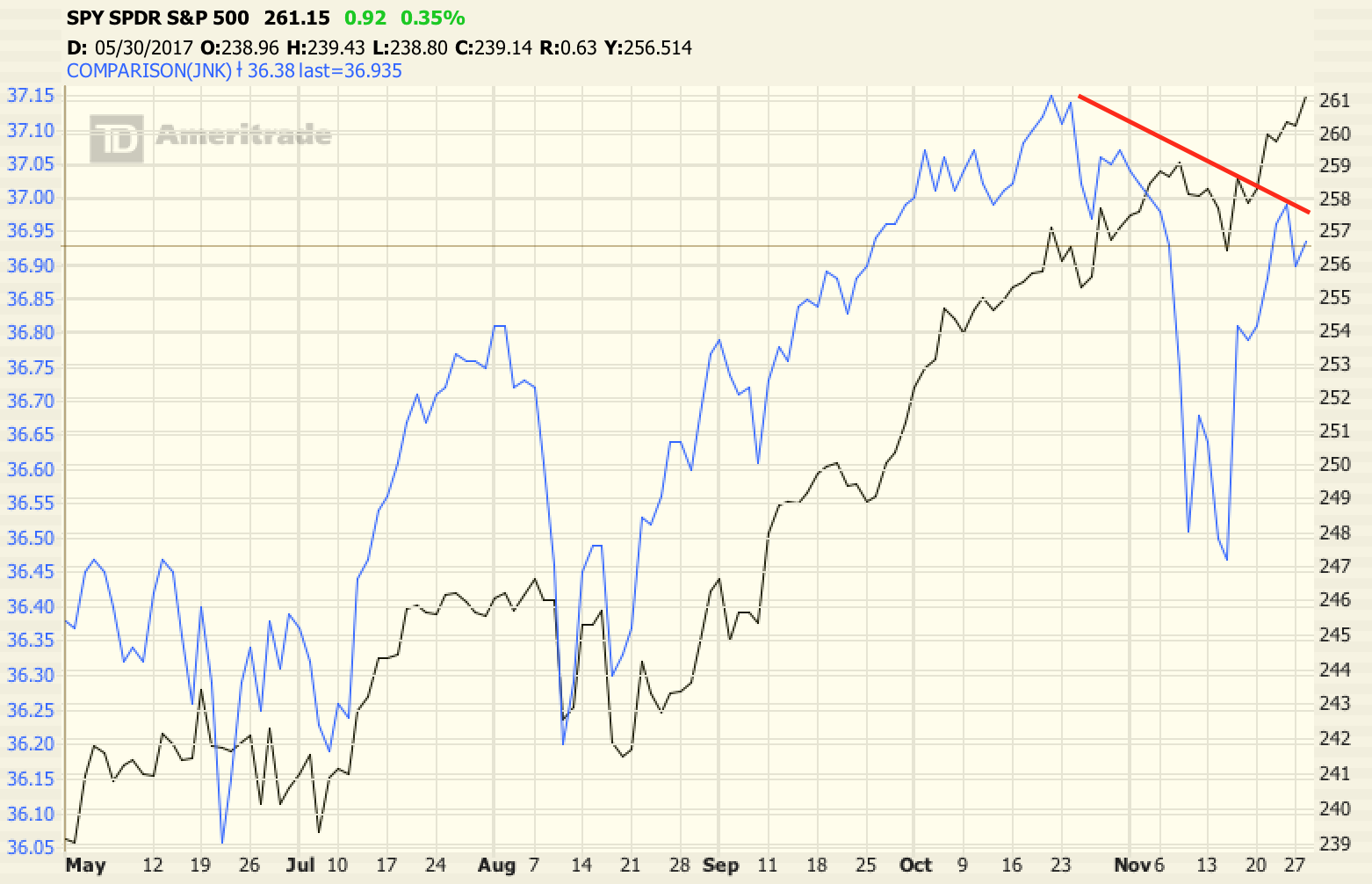

GE, Debt and Dividends A few weeks ago General Electric (GE) announced that they were cutting their dividend in half in order to preserve cash flow. The last two times GE cuts it dividend were 1929 and 2008. That says something about the state of the economy. The stock market is by no means a…

A Case of Deja Vu

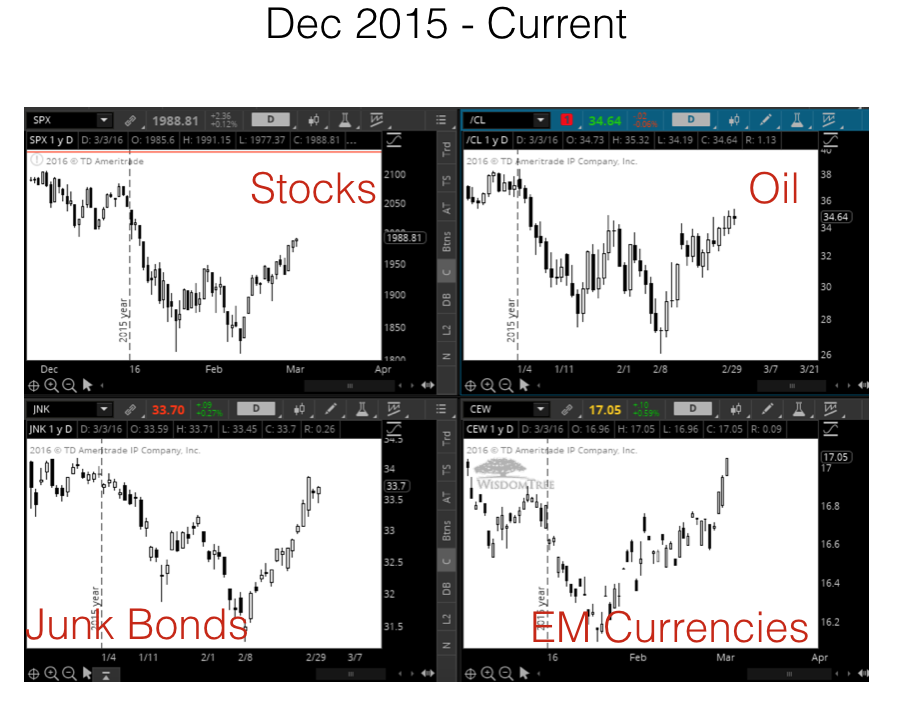

The move in the S&P 500 since January 1st (the selloff, bounce, weak test of the lows and a big surge afterwards) has been so eerily similar to the Aug-Oct move a few months back that it’s a little weird… Even the multiple 2-day retracements in the middle of the surge. The August selloff unfolded after…

Are New Opportunities on the Horizon?

I find it fascinating that the stock market is still so fixated on stimulus (more quantitative easing), which says a lot about the nature of the global economy. Stocks posted a pretty strong rally yesterday after the European Central Bank (ECB) hinted at increasing their QE program. Then, this morning, the futures were driven even…

My Long Term View and How I’m Positioning Portfolios (Oct, 2015)

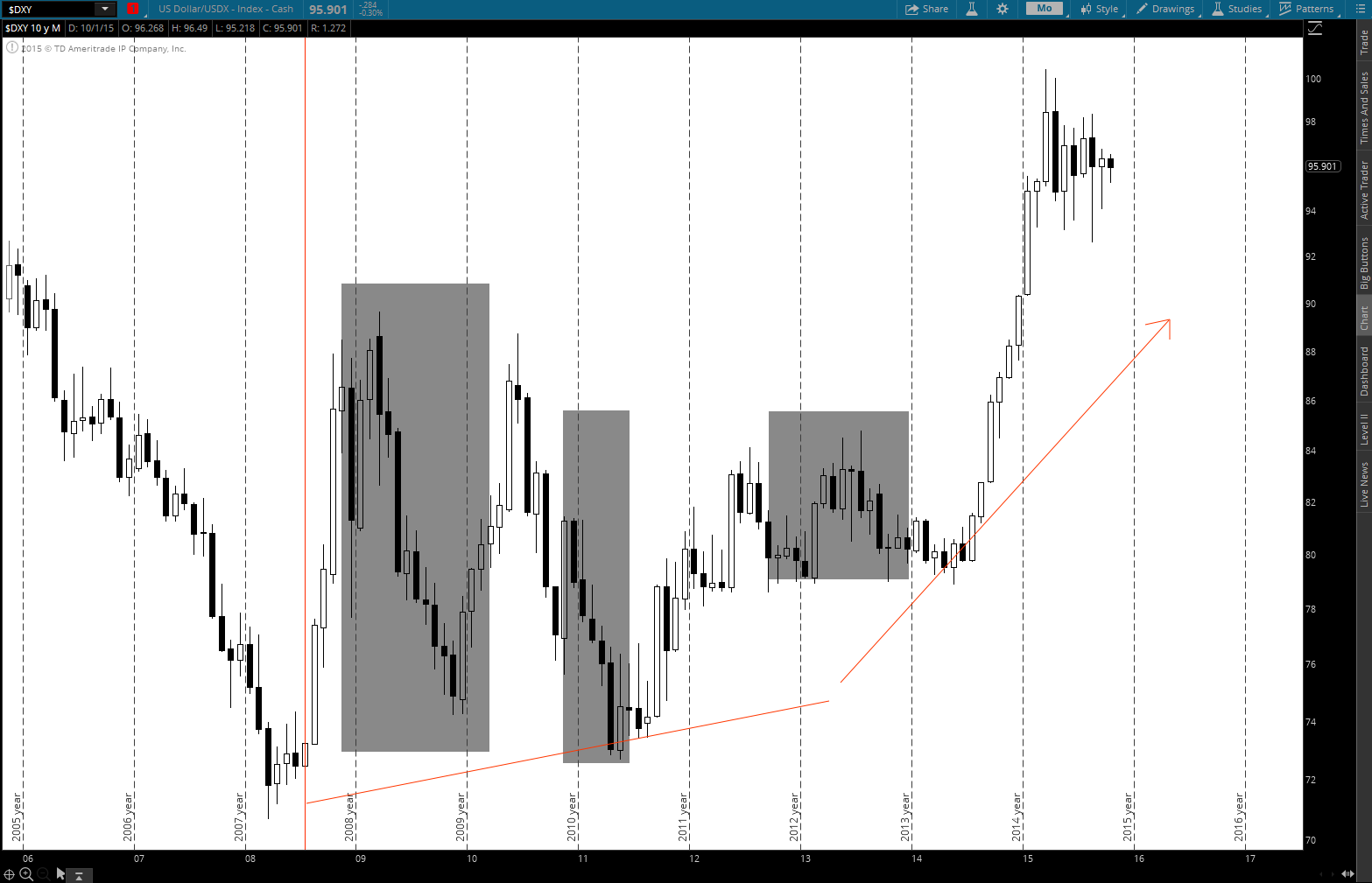

I’ll preface this post by saying that this is a long one (sorry about that) but it’s worth the time. To continue on the post from earlier this week where I mentioned that the best long-term investment opportunities typically come with short-term volatility, I’d like to outline my long-term view on how the world, global…

Market Updates

Well that was exciting! Please keep in mind that, as a long-term investor, what matters is the earnings power and yield of the companies in which you are invested. Just because the price of a stock drops doesn’t mean that the underlying company is deteriorating – it simply means you have the chance to buy…

What China’s Currency Devaluation Means for Markets

Risk assets across the board are trading lower today after China devalued their currency, the renminbi (or “yuan” as it’s referred to in international context), overnight by 1.9%. China currently maintains a peg to the US dollar in order to keep the exchange rate in a very tight band. They do this by intervening each…

Recent Market Musings

China The Chinese stock market has probably been the hottest market over the last year. While exciting for the time being, I don’t trust it one bit. The Chinese economy has been supported by an unsustainable increase in credit the past few years and the bubble has the potential to pop at any moment. There…