I haven’t posted anything in a while because every time I’m about to write an update, a new piece of pretty big news develops that potentially shifts the picture. So here’s a high level overview of my thoughts from the past month. There’s a debate going on right now if the current slowdown will…

Potential Sea Change

Last week’s FOMC meeting may have signaled a coming change in the investment markets. During the press conference, Janet Yellen began to lay out how the Fed will start to reduce its balance sheet (i.e. all of the bonds that they have purchased through QE). She said it could begin in the very near future. …

Impact of the Presidential Election: The 2nd Domino has Fallen

I know this was a very emotional election so, as always, I preface this post by saying that my comments are purely from an objective point of view regarding the impact on the economy and investment markets. I realize there are many other very important social ramifications beyond just finance but I’ll leave those topics…

Chart of the Week: Central Banks Attempting to Monetize the Whole World

The world’s top 6 central banks have now monetized, which means purchased with “printed” money, total assets worth almost $20 trillion (40% of global GDP). Since they’re running out of government bonds to buy (you know, since they’ve pushed yields negative), they’ve moved on to corporate bonds and stocks. The Swiss National Bank (SNB) is now…

Charts of the Week: The Whole Story

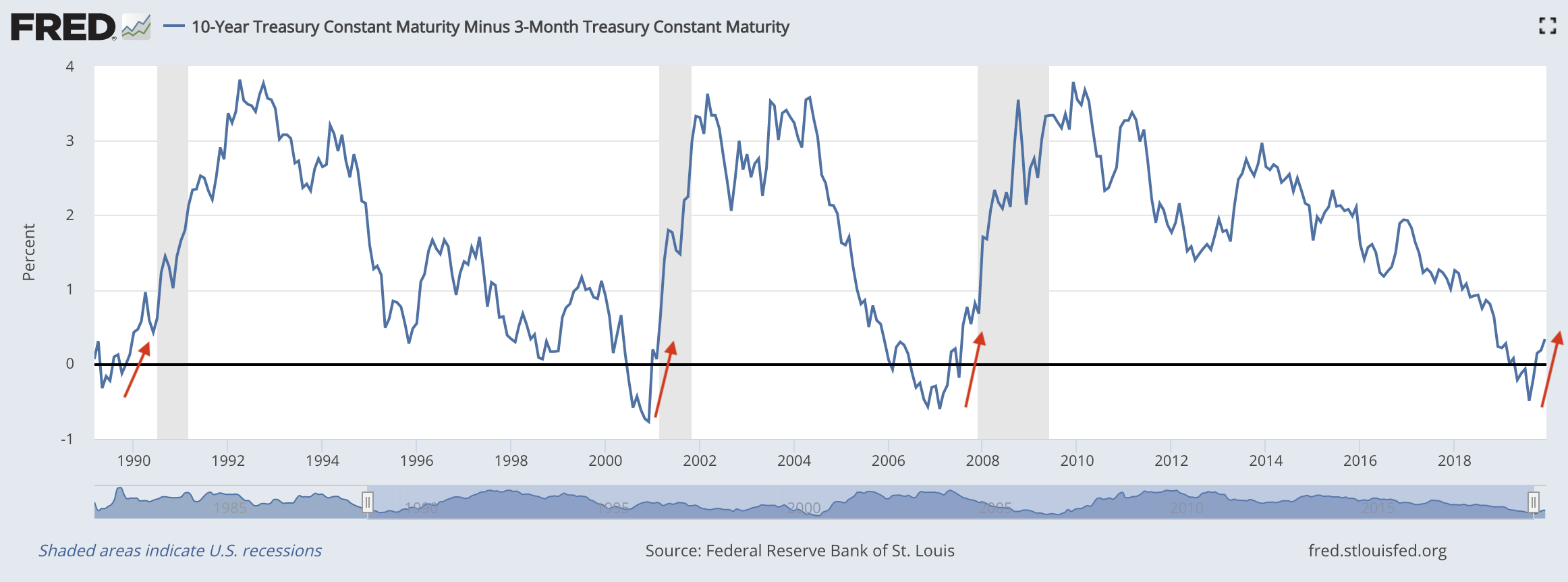

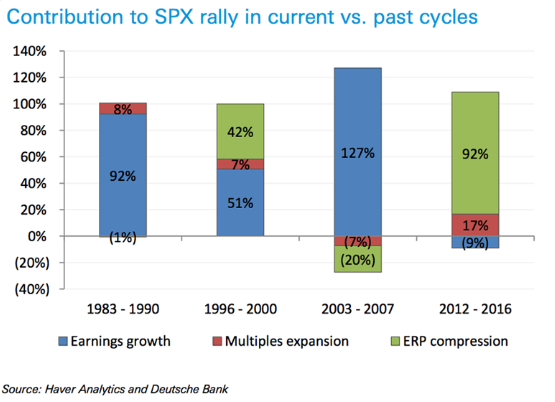

These charts tell the whole story regarding the current state of the global economy and investment markets: Global central bank asset purchases compared to global equity % change (let’s be honest, there’s only one thing that matters…) Deutsche Bank’s recent report on the current stock market rally (’12 to ’16) compared to past market climbs…

Chart of the Week: Consumer Discretionary Stocks are Not on Sale

This goes to show how distorted Quantitative Easing (QE) has made things. It’s a value investors nightmare… It’s important to use your head when investing in this market. A common mistake that investors tend to make is to pick a fund (or stock) based on past performance. They’ll think “look how well this fund has done…

Why Recessions are Necessary for Growth

Why has the economy been stagnant since 2008? Not the stock market…the real economy: real growth, higher wages, etc. Because we never let the system clear itself of waste, excess, inefficiency and poor investment decisions. I think a good analogy to explain this concept is to think of the economy like a balloon. In order…

Chart of the Week: Effects of QE, Straight from the Horse’s Mouth

This week’s Chart of the Week comes from Jesse Felder, a very astute investor. I’ve posted charts like this in the past, illustrating the effects of the Fed’s Quantitative Easing on asset markets, but it’s worth revisiting after the former head of the Dallas Federal Reserve branch, Richard Fisher, openly stated that the main goal of…