I haven’t posted anything in a while because every time I’m about to write an update, a new piece of pretty big news develops that potentially shifts the picture. So here’s a high level overview of my thoughts from the past month. There’s a debate going on right now if the current slowdown will…

The Fed, Curve Inversion & Conflicting Signals

The Federal Reserve raised the target range for the effective federal funds rates (EFF) again last week, now up to a range of 1.75% – 2.00%. They also raised the rate they pay banks interest on excess reserves (IOER) by 0.20%. With this bump, I wanted to see the print for the average bank prime…

Some Key Metrics to Watch

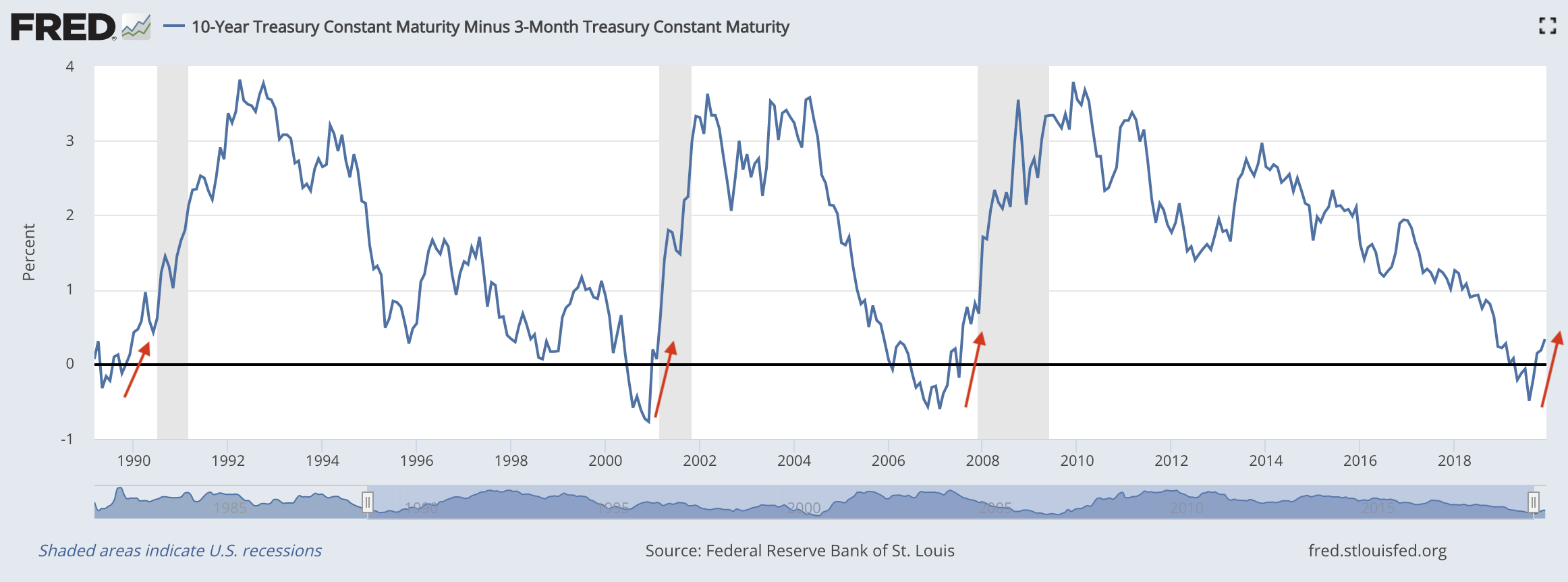

Macro changes occur at a glacial speed but these are typically the most important metrics to track. This is separating the signal (macro shifts, leading data points, etc.) from the noise (CNBC). Warning Signals from the Yield Curve One of the most basic yet crucial metrics is the yield curve, which has certainly received a…