Here are some books and writings that I have found to be the most helpful in shaping my thinking this year. For a longer-term geopolitical framework, I highly recommend Disunited Nations, by Peter Zeihan. It’s a very easy, somewhat fun, yet informative read on the shifting geopolitical tides we’re likely to see play out over…

It’s All Connected – Why Gold is Starting to Shine

If you don’t own gold, you know neither history nor economics. -Ray Dalio I haven’t written anything in a little while because, well, there hasn’t been a whole lot going on to write about. We have had the usual Fed go full-panic-dove-mode, we’ve reportedly made progress on a trade deal with China about 28 times…

Some Key Metrics to Watch

Macro changes occur at a glacial speed but these are typically the most important metrics to track. This is separating the signal (macro shifts, leading data points, etc.) from the noise (CNBC). Warning Signals from the Yield Curve One of the most basic yet crucial metrics is the yield curve, which has certainly received a…

My Long Term View and How I’m Positioning Portfolios (Oct, 2015)

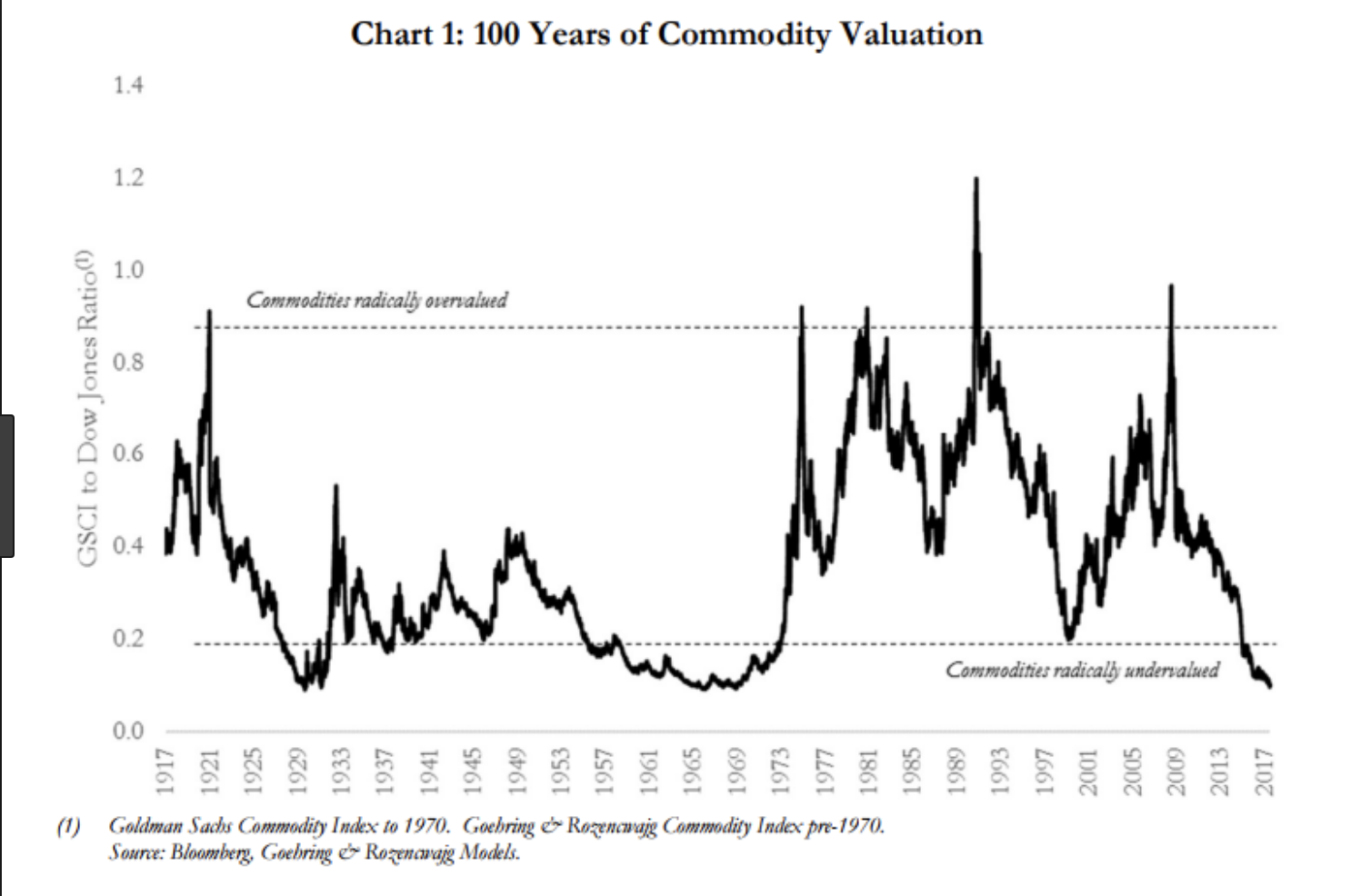

I’ll preface this post by saying that this is a long one (sorry about that) but it’s worth the time. To continue on the post from earlier this week where I mentioned that the best long-term investment opportunities typically come with short-term volatility, I’d like to outline my long-term view on how the world, global…

Why the Stock Market Dropped So Sharply

Two words – “The Fed.” The two primary goals of the Federal Reserve’s Quantitative Easing efforts over the past few years were to inflate asset prices (stocks, real estate, etc.) and lower interest rates. They call this the “wealth effect.” In theory, they think that higher asset prices will increase confidence, which will increase spending, business…

What the Stock Market seems to be Ignoring

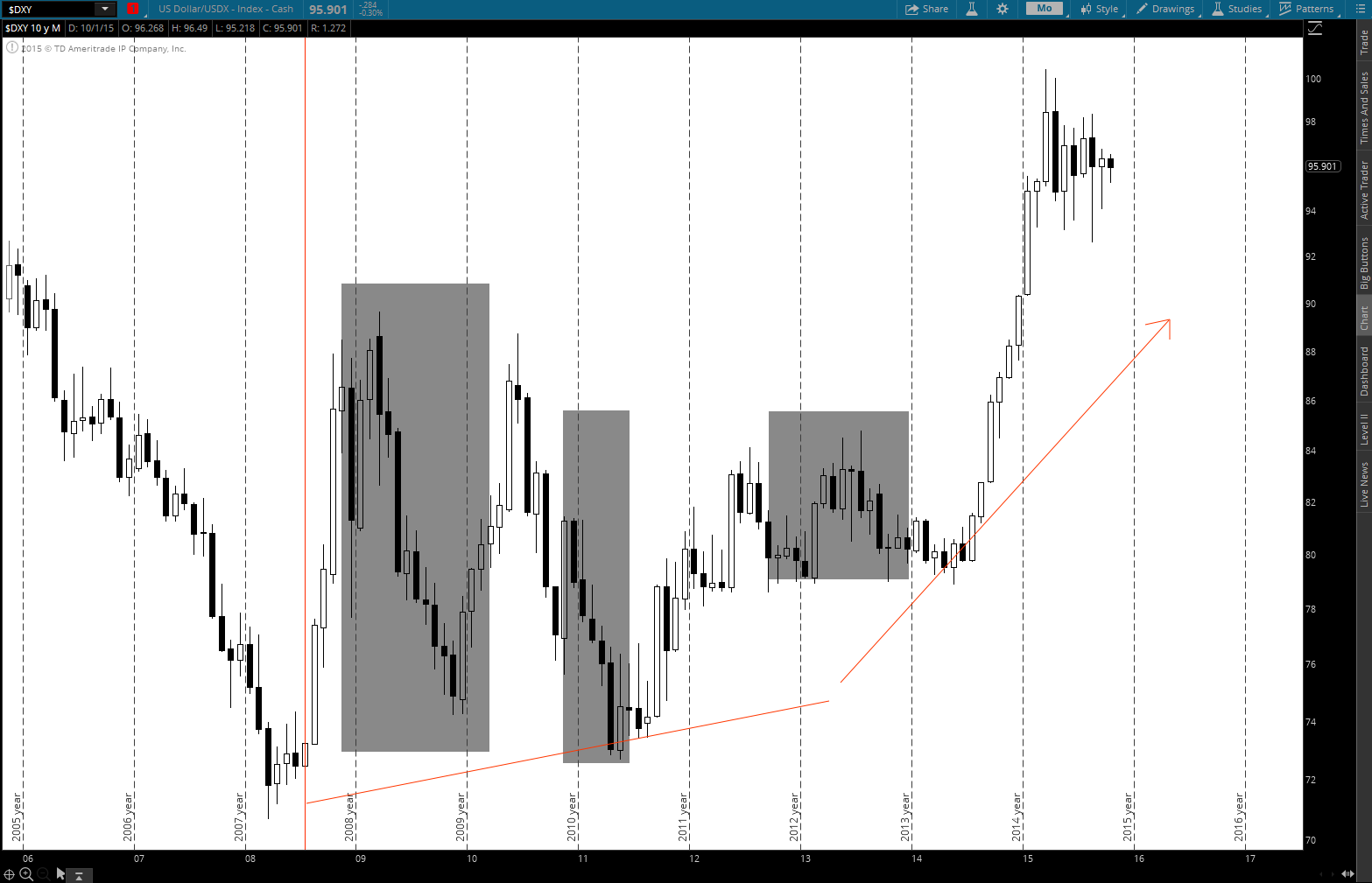

Signs of deflation have been popping up all over global asset markets for the past year, ever since the US dollar broke-out on its tear higher. US dollar index – 2 years But this doesn’t even tell the whole story. The US dollar index represents the value of the US dollar against a basket…

Welcome to a World of Deflation

Here’s a chart to illustrate what happens during deflationary economic pressures, as we’re seeing right now (click to see a larger image): In order from top to bottom: Long-term Treasury Bonds (orange), US dollar (black), Emerging Markets (brown), Euro (Green), Yen (blue), Energy/oil (purple) – last 9 months Too much debt, not enough demand (poor…

Inflation or Deflation?

I’ve noticed lately that inflation continues to “surprise” to the downside, to a small degree here in the US but mainly overseas (notably Europe, Australia and Canada), creating expectations of further monetary easing. This is leaving many people who have been calling for hyperinflation and the collapse of fiat currencies scratching their heads. They say…