The move in the S&P 500 since January 1st (the selloff, bounce, weak test of the lows and a big surge afterwards) has been so eerily similar to the Aug-Oct move a few months back that it’s a little weird… Even the multiple 2-day retracements in the middle of the surge. The August selloff unfolded after…

Chart of the Week: Tertiary Impact of Lower Oil Prices

There was an article in the Wall Street Journal this week discussing the approximately 5-fold rise of Sovereign Wealth Fund assets off the back of rising oil prices over the past decade. Now that oil prices have fallen from over $100 per barrel to the mid-$30’s, most countries have begun tapping their funds to fill the…

Here’s What Happens When you Play with Fire

Earlier this year I cut all exposure to energy except for one company… A few month later, I started cutting back on all companies that were highly leveraged with debt because I could see the turn in the credit cycle coming and I knew that companies that were relying on the ability to access the…

What the Stock Market seems to be Ignoring

Signs of deflation have been popping up all over global asset markets for the past year, ever since the US dollar broke-out on its tear higher. US dollar index – 2 years But this doesn’t even tell the whole story. The US dollar index represents the value of the US dollar against a basket…

Welcome to a World of Deflation

Here’s a chart to illustrate what happens during deflationary economic pressures, as we’re seeing right now (click to see a larger image): In order from top to bottom: Long-term Treasury Bonds (orange), US dollar (black), Emerging Markets (brown), Euro (Green), Yen (blue), Energy/oil (purple) – last 9 months Too much debt, not enough demand (poor…

S&P 500: Early Warning Signals Beginning to Flash

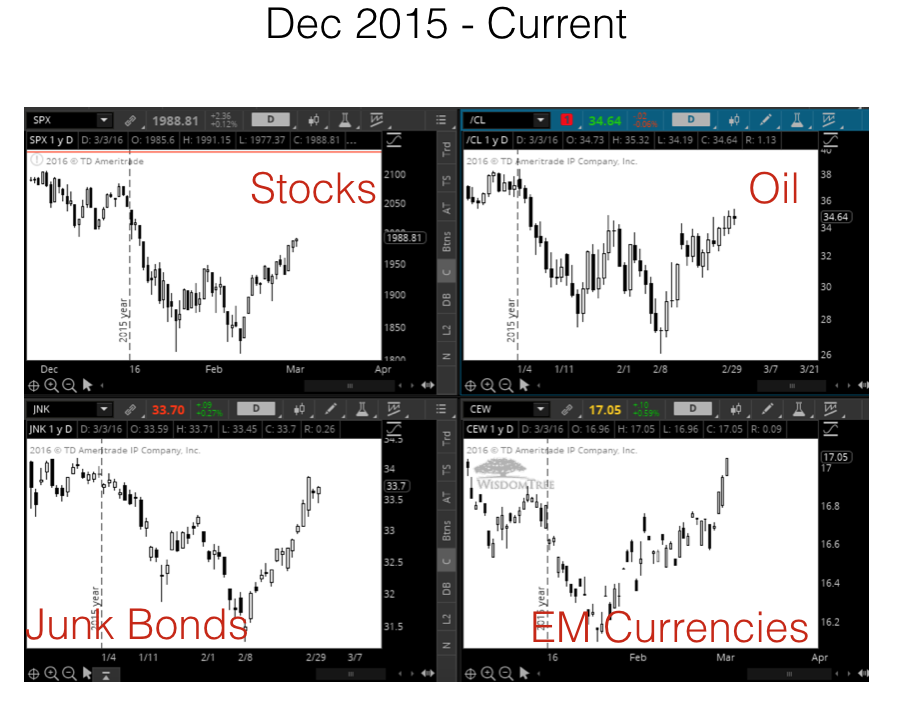

Two of the best ways to track investor’s sentiment toward risk are to track the Volatility Index (VIX) relative to stocks and high yield bonds relative to stocks – and both have been flashing “warning” signs since early July. These are important to watch because stocks are usually the last asset class to react to…

On the Lookout for Some Holiday Deals & New Year Trend Changes

The end of the year tends to bring some odd movements in the markets. These can occur for a handful of reasons but most are driven by funds with short-term incentive policies and year-end bonuses. Fortunately, their short-sighted foolishness can be our gain since we’re in the position of investing for the long-term. Many funds…