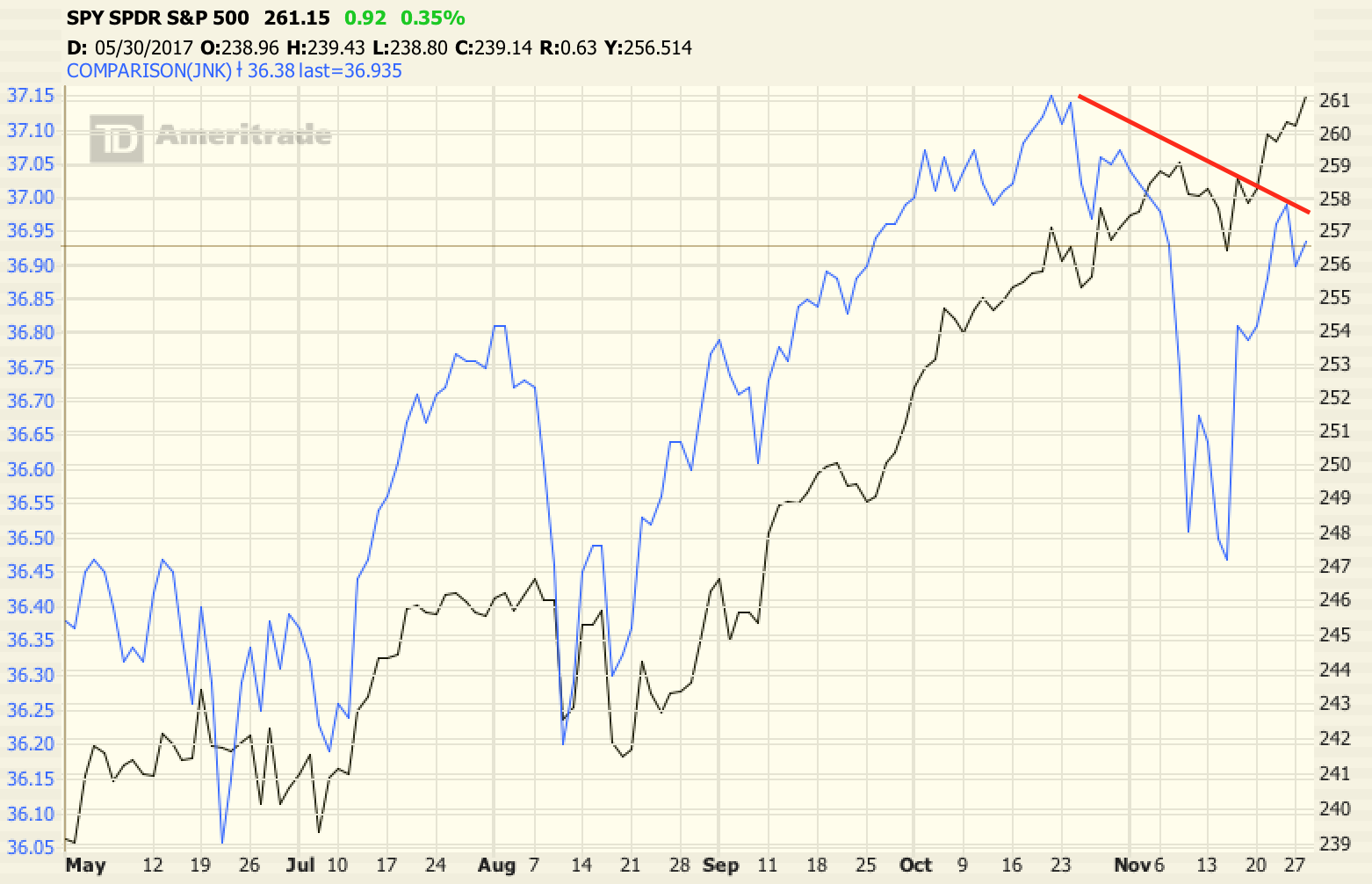

For most of this spring, I’ve been telling clients that I’ve been in “wait and see” mode. The US dollar, bonds and stocks have all been rallying this year, and while that can happen in the short-term, the dynamics of the market say that can’t last in the long run. Basically, 1 of the 3…

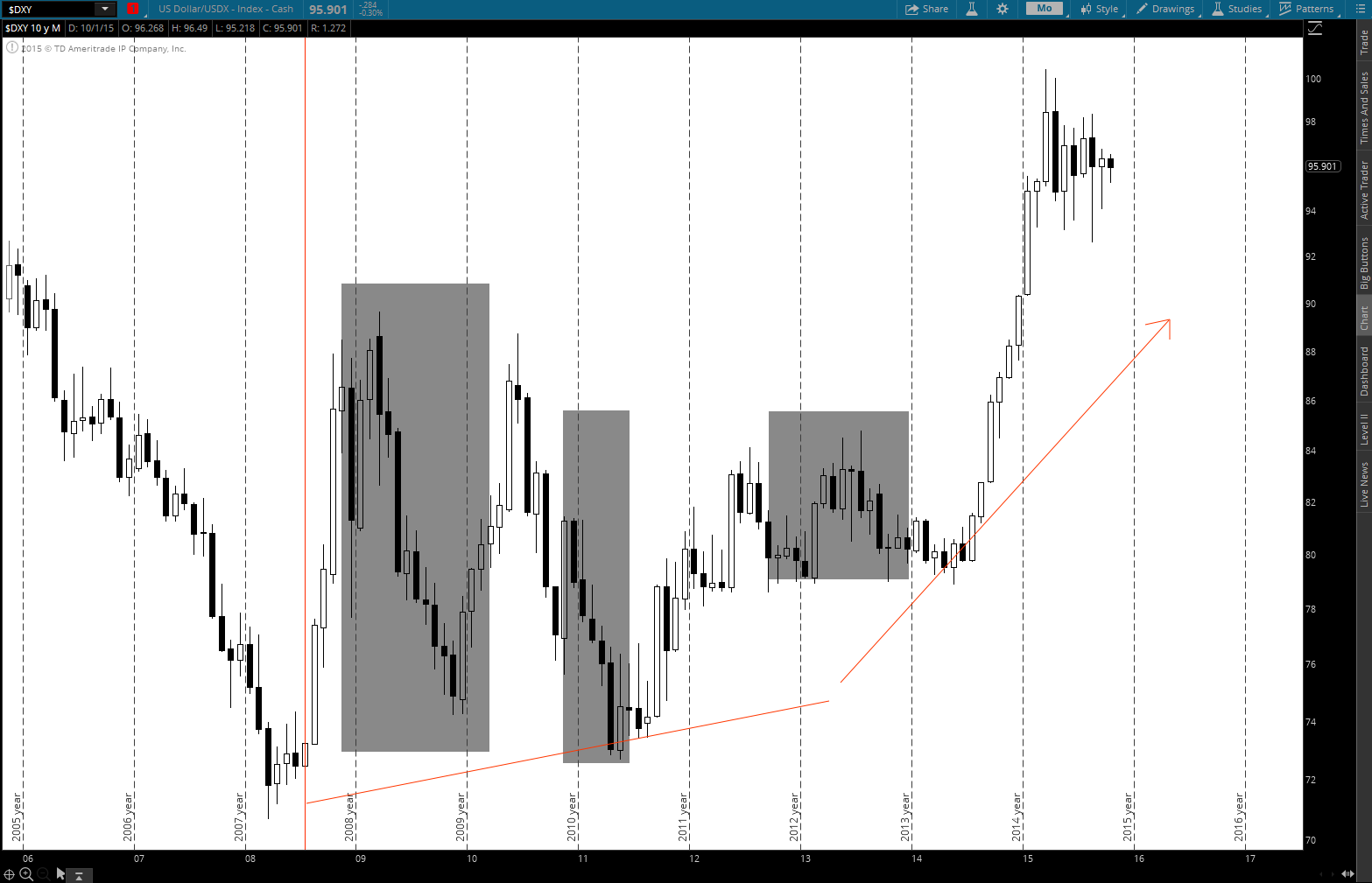

The Pain & Opportunity of a Dollar Squeeze

Global investment markets are becoming very macro driven and it’s pretty important to understand the big picture dynamics at play right now. The US dollar is the key to everything and there has been a growing shortage of dollars throughout the global economy over the past few years which we’re now seeing create the usual…

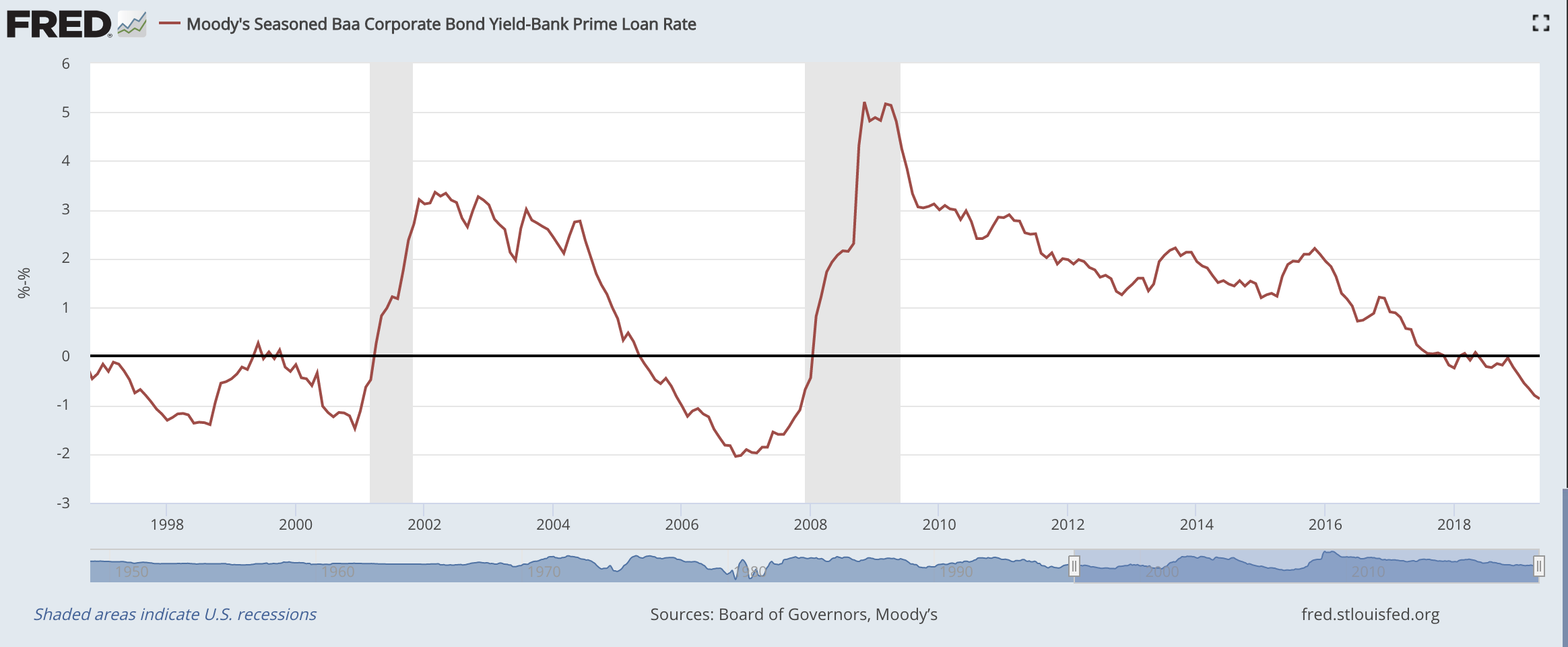

GE, a Lesson on the Perils of Debt and the Current Market Environment

GE, Debt and Dividends A few weeks ago General Electric (GE) announced that they were cutting their dividend in half in order to preserve cash flow. The last two times GE cuts it dividend were 1929 and 2008. That says something about the state of the economy. The stock market is by no means a…

Making Sense of the Nonsense

I’d like to comment on two things that have been a huge disservice to the average (nonprofessional) investor. One is CNBC and the second is the Federal Reserve. Do yourself a favor and don’t watch CNBC. Like all media companies, CNBC is in the business of collecting eyeballs. They want strong ratings so they can…

Allergan – the Gift that Keeps on Giving

Pfizer and Allergan have announced a “merger” where Pfizer is essentially acquiring Allergan so it can perform a tax inversion to relocate to Ireland (where Allergan is based). This is the second time Allergan has been acquired since we purchased it back in June, 2013, with the first being the takeover by Actavis last fall. Then…

Are New Opportunities on the Horizon?

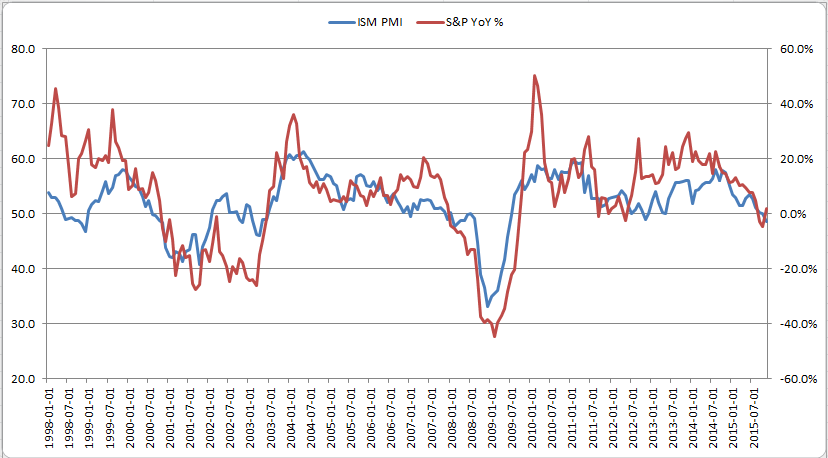

I find it fascinating that the stock market is still so fixated on stimulus (more quantitative easing), which says a lot about the nature of the global economy. Stocks posted a pretty strong rally yesterday after the European Central Bank (ECB) hinted at increasing their QE program. Then, this morning, the futures were driven even…

My Long Term View and How I’m Positioning Portfolios (Oct, 2015)

I’ll preface this post by saying that this is a long one (sorry about that) but it’s worth the time. To continue on the post from earlier this week where I mentioned that the best long-term investment opportunities typically come with short-term volatility, I’d like to outline my long-term view on how the world, global…

Why the Stock Market Dropped So Sharply

Two words – “The Fed.” The two primary goals of the Federal Reserve’s Quantitative Easing efforts over the past few years were to inflate asset prices (stocks, real estate, etc.) and lower interest rates. They call this the “wealth effect.” In theory, they think that higher asset prices will increase confidence, which will increase spending, business…