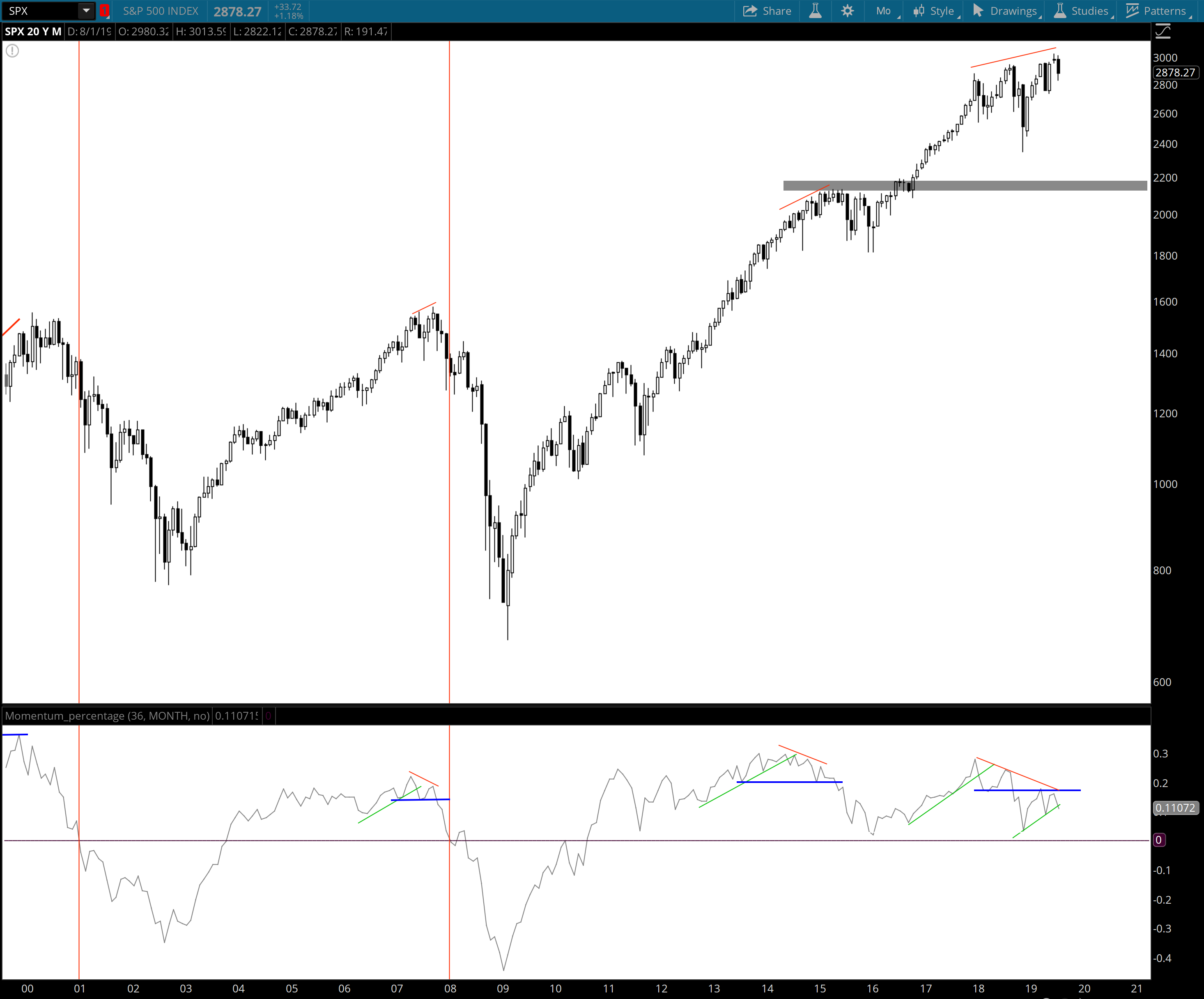

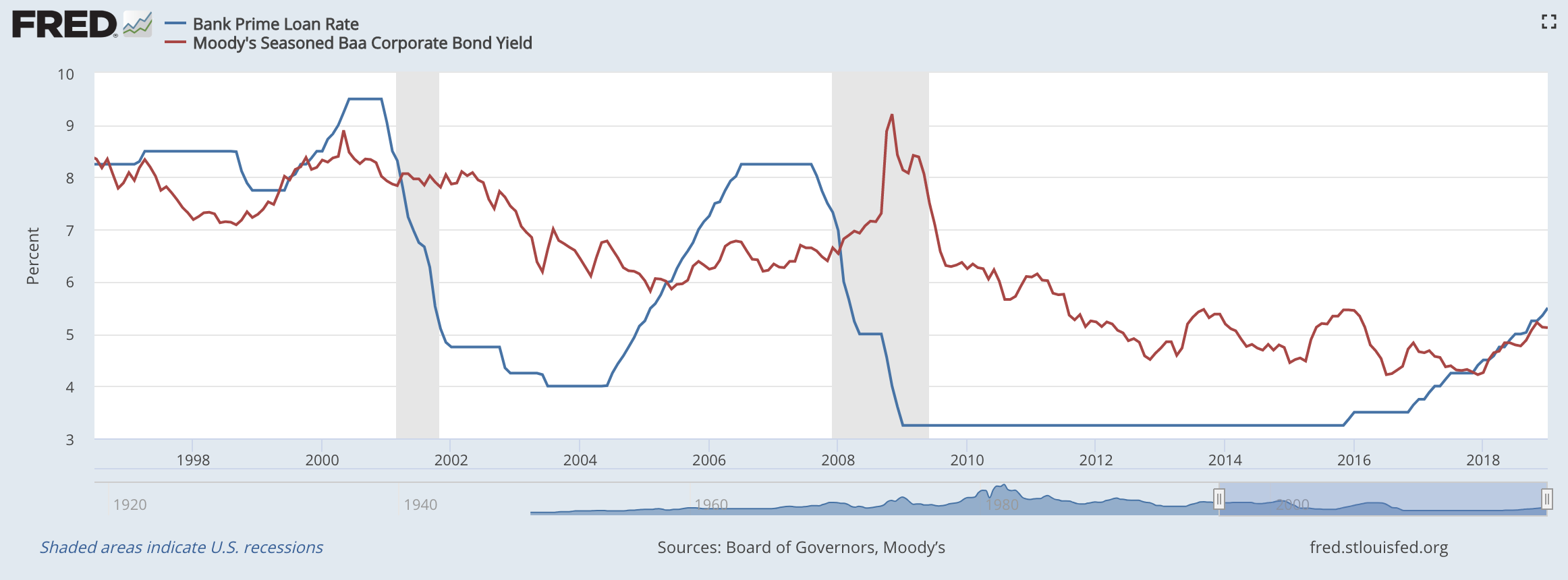

Last week the Fed cuts interest rates for the first time since the GFC a decade ago and the market’s response was pretty interesting. After referencing the 1995/96 one-and-done cut that prolonged the 90’s expansion all summer, I think they were hoping that they could get away with one cut as “insurance” that would ease…

Macro Update

Unsurprisingly, the Fed finally got the message from the markets and pulled a hard 180 last month. In a very short six weeks, they went from “balance sheet runoff on autopilot and more rate increases to come in 2019” to “we’re pausing rate increases and we’ll be flexible with the balance sheet.” Risk assets have…

Chart of the Week: Stocks as Bond Proxies

This week’s chart comes from yours truly. For much of the year, and especially so since Treasury yields broke to new lows after the Brexit vote, the “safe” high yielding stocks like Utilities, Consumer Staples and Telecom have been tracking daily changes in the bond market – not the stock market. If bond yields move…

The Concept of a Superior Investment

Everyone knows what it means when something is superior to something else. In this post, I’ll try to explain how I view potential investments in terms of superiority and what a superior investment looks like to me. Let’s say we’re looking at 3 potential investments: A, B & C. If B is superior to C…

Chart of the Week: Not a Good Sign for Global Stock Markets

The chart below was going around a lot last week. It shows a composition of AP Moller-Maersk (the world’s largest container shipping company) and Sotheby’s (the auction house of high-end art, etc.) in blue vs. the MSCI World Stock Index in orange. That’s a pretty tight correlation and a pretty wide gap we’re seeing right…

Allergan – the Gift that Keeps on Giving

Pfizer and Allergan have announced a “merger” where Pfizer is essentially acquiring Allergan so it can perform a tax inversion to relocate to Ireland (where Allergan is based). This is the second time Allergan has been acquired since we purchased it back in June, 2013, with the first being the takeover by Actavis last fall. Then…

Why I Don’t Trust this Bounce in Stocks

One of the most important determinants of stock market returns in the short/intermediate term is investor appetite for risk. When investors in the market are confident and display risk seeking behavior, we tend to see assets (like stocks) ignore bad news and rally on good news. However, the reverse occurs when investors are displaying a…

What the Stock Market seems to be Ignoring

Signs of deflation have been popping up all over global asset markets for the past year, ever since the US dollar broke-out on its tear higher. US dollar index – 2 years But this doesn’t even tell the whole story. The US dollar index represents the value of the US dollar against a basket…