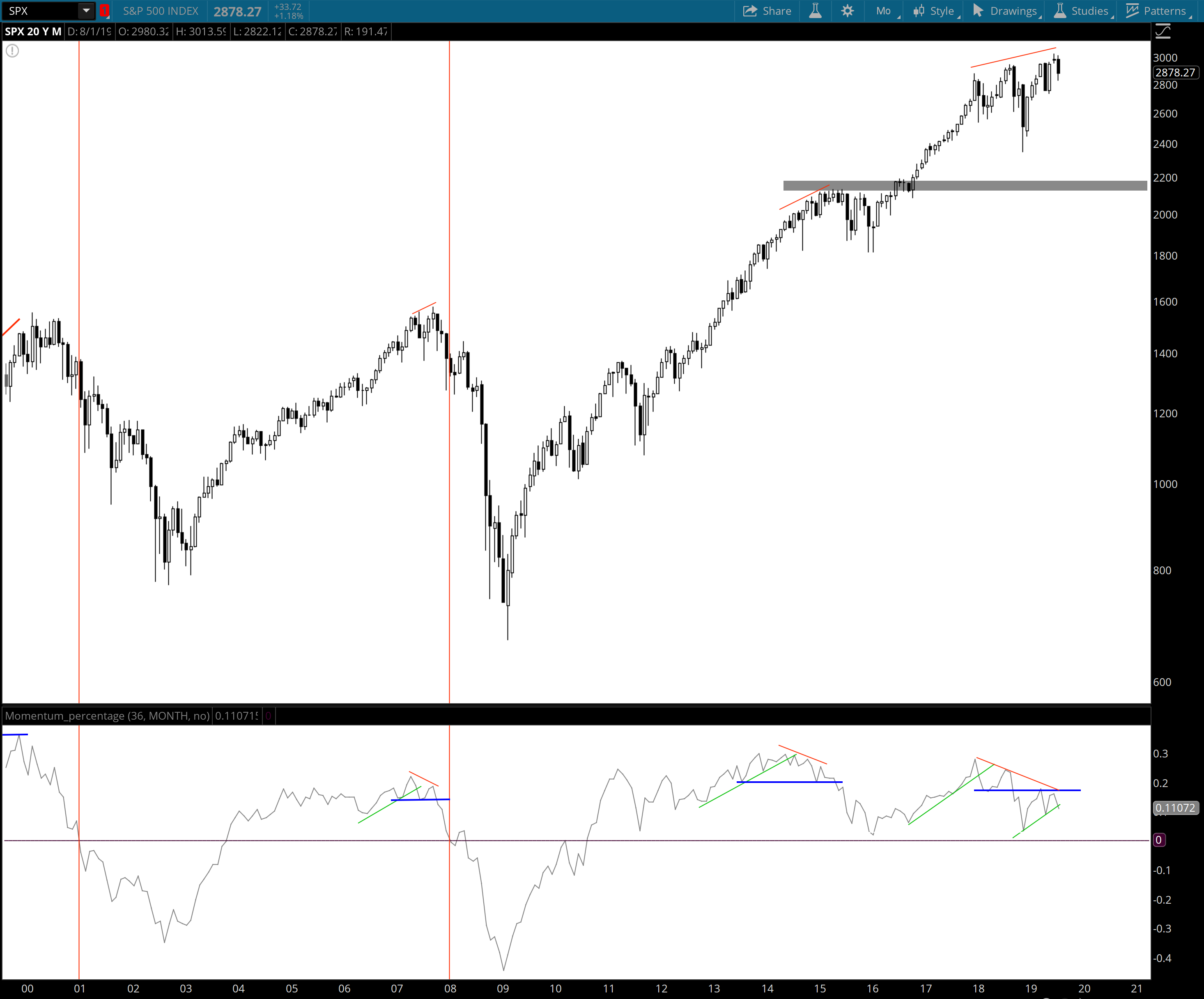

I’m going to try to keep this post a little shorter by not getting too deep into the explanations but I wanted to post an update with my thoughts based on what I’m seeing. Given the weakening economic backdrop, the risk across the board is probably at its highest point right now since 2007/08. The…

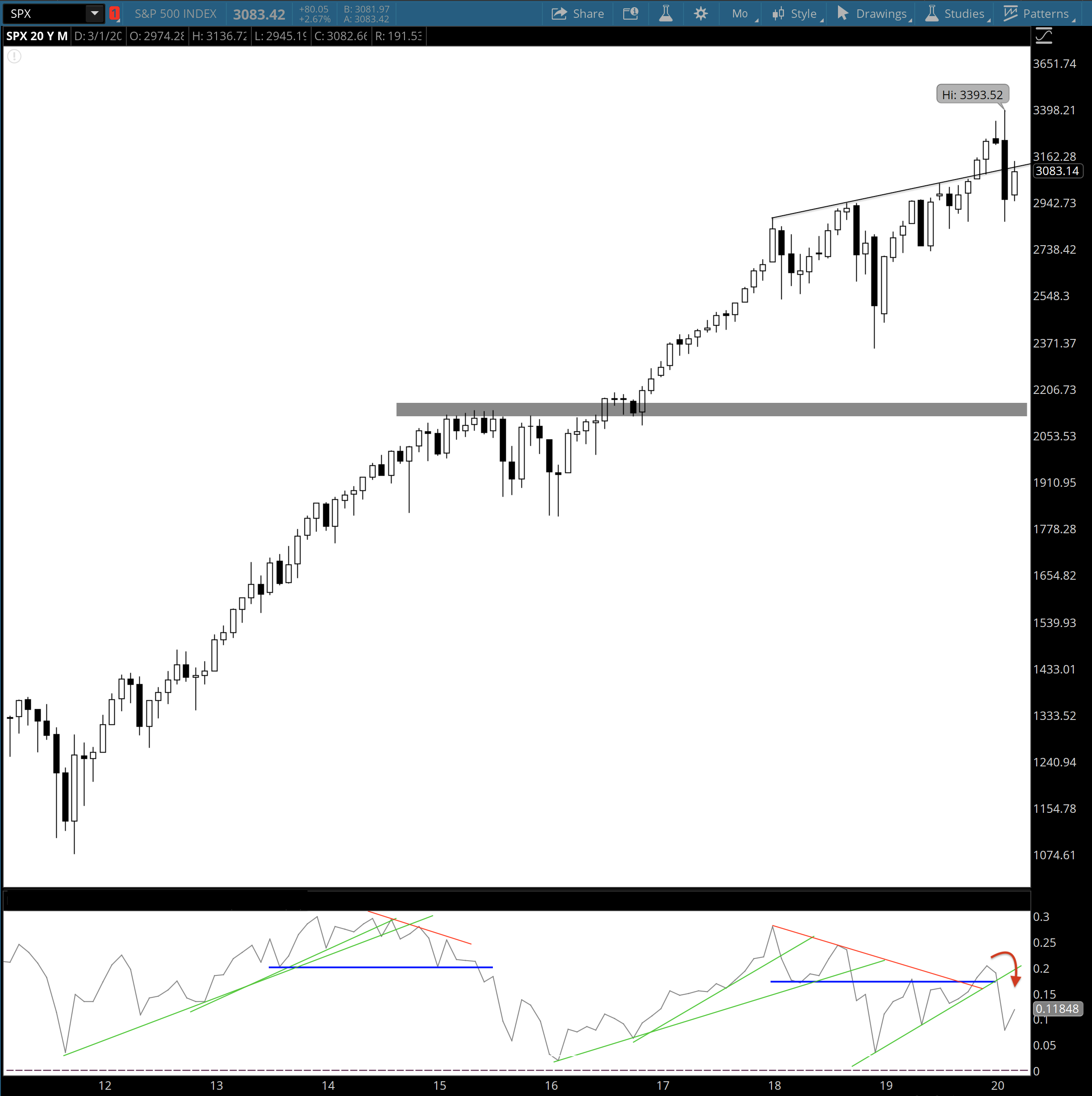

Markets & Macro Update – Aug 6th, 2019

Last week the Fed cuts interest rates for the first time since the GFC a decade ago and the market’s response was pretty interesting. After referencing the 1995/96 one-and-done cut that prolonged the 90’s expansion all summer, I think they were hoping that they could get away with one cut as “insurance” that would ease…

Macro Update: Stocks, Bonds, and the Dollar – One is Wrong

For most of this spring, I’ve been telling clients that I’ve been in “wait and see” mode. The US dollar, bonds and stocks have all been rallying this year, and while that can happen in the short-term, the dynamics of the market say that can’t last in the long run. Basically, 1 of the 3…

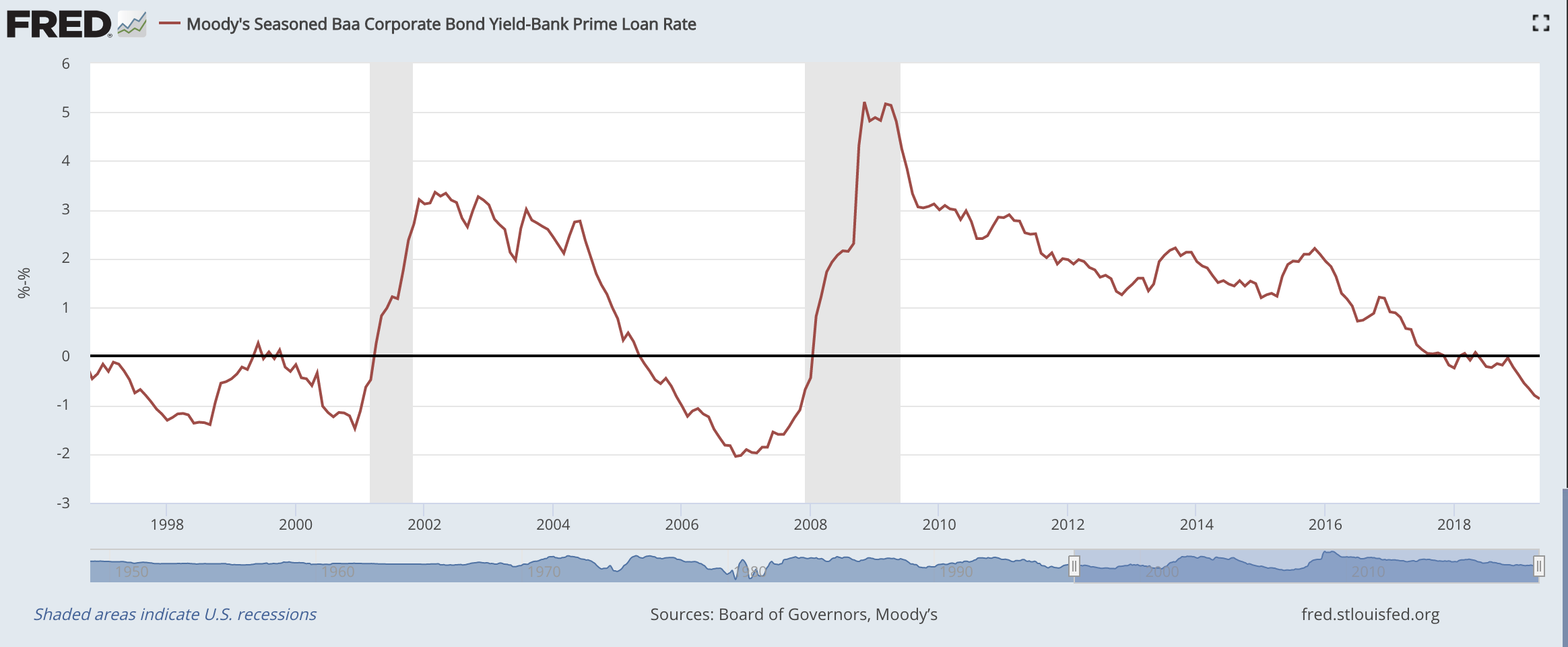

The Fed, Curve Inversion & Conflicting Signals

The Federal Reserve raised the target range for the effective federal funds rates (EFF) again last week, now up to a range of 1.75% – 2.00%. They also raised the rate they pay banks interest on excess reserves (IOER) by 0.20%. With this bump, I wanted to see the print for the average bank prime…

Chart of the Week: US Interest Rates vs. Japanese Rates

Here’s a chart I saw over the weekend comparing the current path of the US Federal Funds Rate (blue line) to the path of the Japanese Policy Rate (red dotted) 16 years ago. The United States is not Japan. But our demographic structure today is very similar to Japan’s 15-20 years ago, and demographics ultimately…

Allergan – the Gift that Keeps on Giving

Pfizer and Allergan have announced a “merger” where Pfizer is essentially acquiring Allergan so it can perform a tax inversion to relocate to Ireland (where Allergan is based). This is the second time Allergan has been acquired since we purchased it back in June, 2013, with the first being the takeover by Actavis last fall. Then…

Recent Market Musings

China The Chinese stock market has probably been the hottest market over the last year. While exciting for the time being, I don’t trust it one bit. The Chinese economy has been supported by an unsustainable increase in credit the past few years and the bubble has the potential to pop at any moment. There…

Reflections from the Week

It seems like the only thing I hear in the financial media these days is talk about when the Fed will raise interest rates but I think people are missing the forest for the trees. The US dollar continues to surge higher and by letting it rise, effectively the Fed is already tightening. I don’t…