Asset markets move in cycles, flipping between periods of growth and decline (or consolidation). You can see these cycles in pretty much every asset class and on multiple levels due to the fractal nature of markets. This means there is a short-term cycle within an intermediate-term cycle within a long-term cycle, and so on. You…

Starbucks, Dividends and the Power of Compounding

I purchased stock in Starbucks (SBUX) last week when the stock was trading down about 5% following an earnings release that fell short of analyst expectations. I love it when short-term momentum traders bail on a great long-term story, creating an opportunity for us to buy. After an over 2 year hiatus, we’re back to…

An Intro to Technical Analysis: Seeing Some Structural Weakness

Technical Analysis is the study of charts, chart patterns and indicators. Purely fundamental investors who study balance sheets and cash flow statements think it’s a complete waste of time whereas chart technicians think it’s all that matters. I say, why not be well versed in both? I’ve found it to be extremely valuable in helping…

Say Hello to Your New “Synthetic” Corporate Bonds

Investors have been “starved” for yield for years now and unfortunately interest rates aren’t going up anytime soon. When looking at individual bonds, investors get to choose between high quality bonds at paltry yields or junk-rated bonds that look attractive but come with a slew of bad risks that often aren’t understood or appropriate for…

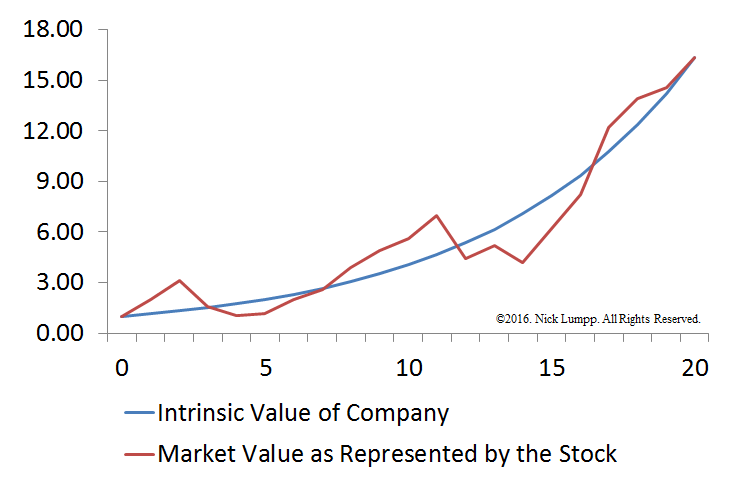

How to Produce Outsized Long-Term Returns from the Perspective of Value Investing

I’m going to let you in on a little secret: Wall Street doesn’t look out beyond 1 year. That’s it. Just 1… Wall Street is part of the brokerage industry and all that the brokerage industry cares about is making sure: 1) you remain invested in their expensive products, and 2) you continually churn your…

High Alert on US Stocks

The S&P 500 failed to close above some key levels last Friday for the end of the month which raises the probability we see some weakness this month. Interestingly, I recently read that the range of the stock market this year has been the tightest market since the 1880’s. So we’ll see if any weakness…