I generally look at Growth investments in one of two ways: either steady compounders or huge reward-to-risk, asymmetric growth opportunities. The steady compounders are the companies that can consistently post growth year after year in a secular manner – secular meaning a long-term story not affected by short-term cycles. Whereas the high growth opportunities tend…

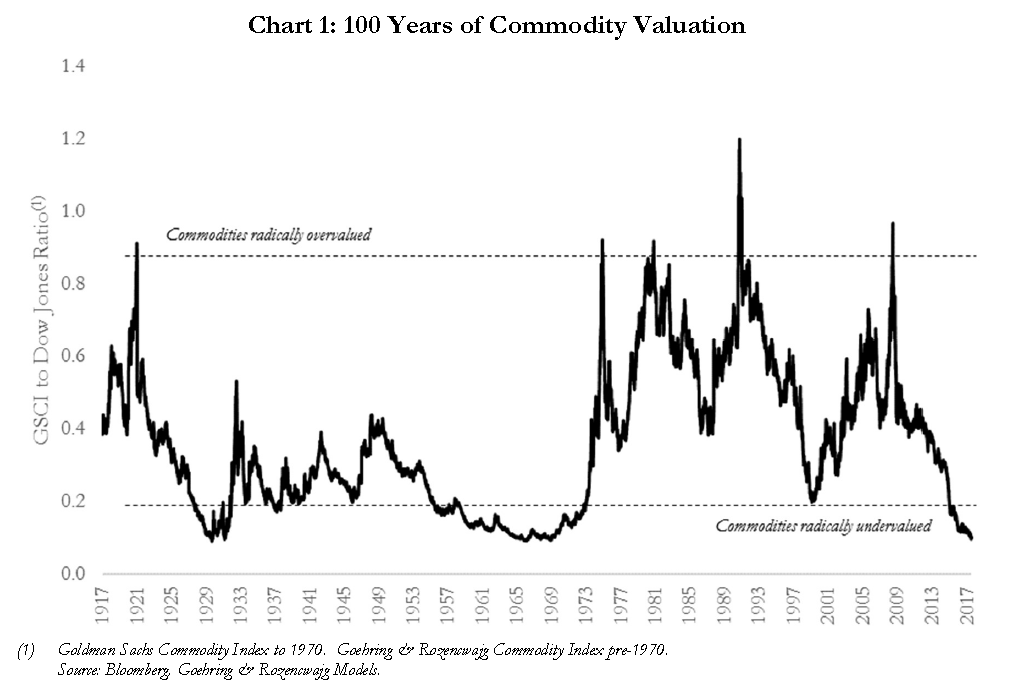

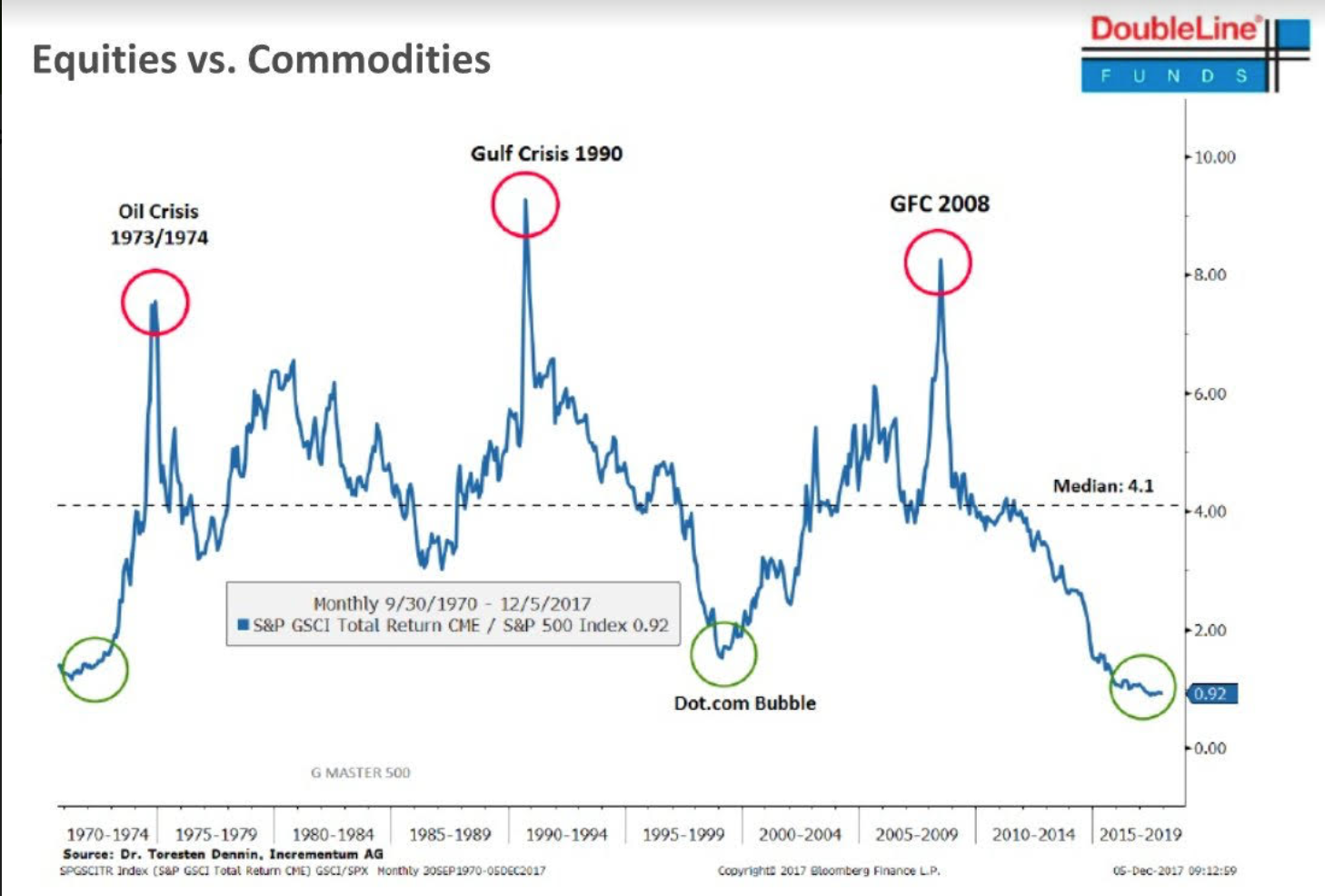

Why 2018 Might be the Year of Commodities

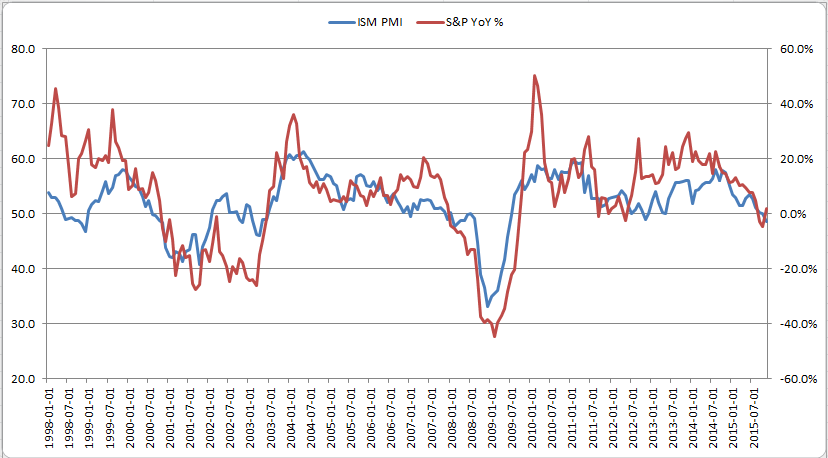

I’ve been telling my clients over the past few months that I expect inflation to pick up moving forward. The decline in the dollar this year and subsequent rally in most energy and industrial commodities is creating the year-over-year price change to bleed through to various inflation measures like CPI, PCE and (ISM) prices paid…

A Case of Deja Vu

The move in the S&P 500 since January 1st (the selloff, bounce, weak test of the lows and a big surge afterwards) has been so eerily similar to the Aug-Oct move a few months back that it’s a little weird… Even the multiple 2-day retracements in the middle of the surge. The August selloff unfolded after…

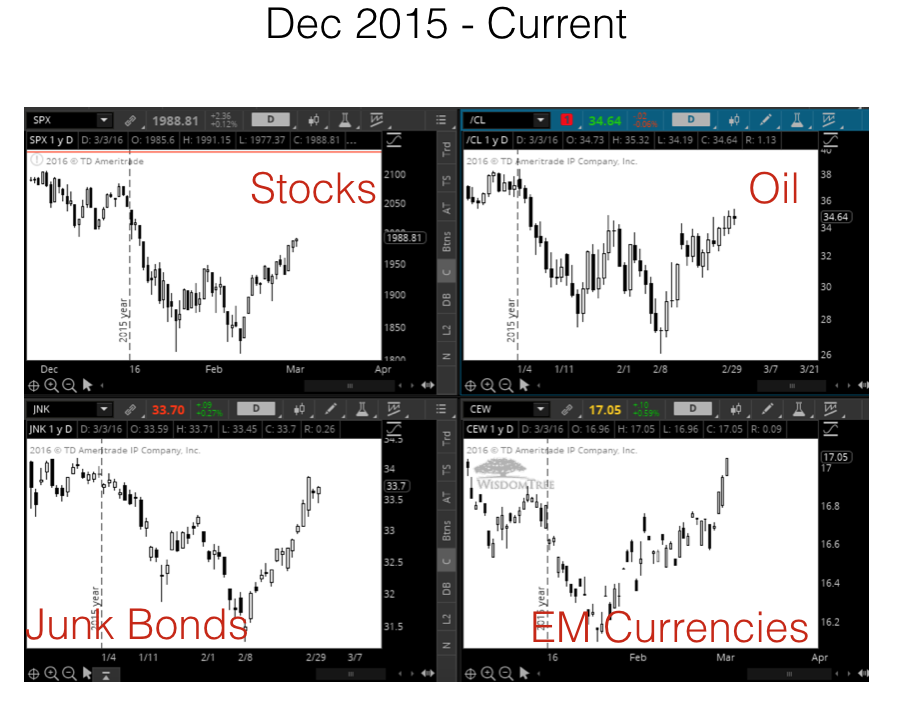

Here’s What Happens When you Play with Fire

Earlier this year I cut all exposure to energy except for one company… A few month later, I started cutting back on all companies that were highly leveraged with debt because I could see the turn in the credit cycle coming and I knew that companies that were relying on the ability to access the…

Making Sense of the Nonsense

I’d like to comment on two things that have been a huge disservice to the average (nonprofessional) investor. One is CNBC and the second is the Federal Reserve. Do yourself a favor and don’t watch CNBC. Like all media companies, CNBC is in the business of collecting eyeballs. They want strong ratings so they can…

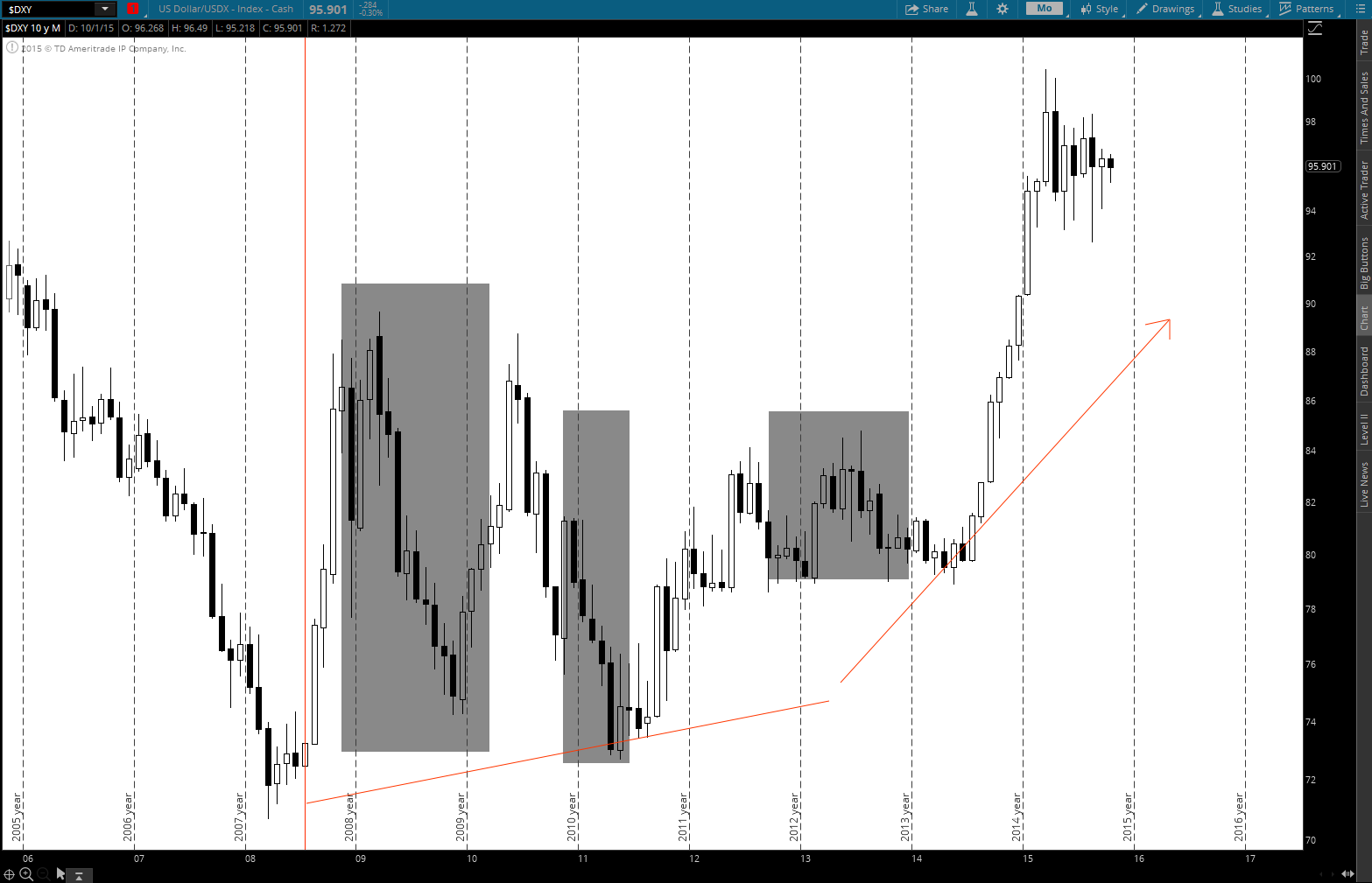

My Long Term View and How I’m Positioning Portfolios (Oct, 2015)

I’ll preface this post by saying that this is a long one (sorry about that) but it’s worth the time. To continue on the post from earlier this week where I mentioned that the best long-term investment opportunities typically come with short-term volatility, I’d like to outline my long-term view on how the world, global…

Why the Stock Market Dropped So Sharply

Two words – “The Fed.” The two primary goals of the Federal Reserve’s Quantitative Easing efforts over the past few years were to inflate asset prices (stocks, real estate, etc.) and lower interest rates. They call this the “wealth effect.” In theory, they think that higher asset prices will increase confidence, which will increase spending, business…

What China’s Currency Devaluation Means for Markets

Risk assets across the board are trading lower today after China devalued their currency, the renminbi (or “yuan” as it’s referred to in international context), overnight by 1.9%. China currently maintains a peg to the US dollar in order to keep the exchange rate in a very tight band. They do this by intervening each…