Last week I purchased stock in a new long-term investment within my client’s Growth allocation that I’m pretty excited about. The company is called OPKO Health (OPK) and is run by Dr Phillip Frost who is often referred to as the Warren Buffett of healthcare. Studying a company’s management team and Board of Directors is…

Chart of the Week: Valuations and Forward Returns

Price is what you pay. Value is what you get. -Warren Buffett Here’s a chart showing the relationship between the S&P 500’s Price-to-Earnings (P/E) ratio and annualized returns over the next 2 years. It simply shows that your expected return is high when you buy something cheap, and low when you buy something expensive. On…

New Stock Investments

I added to some existing positions (like Google and Celgene) during the selloff following the Brexit vote but also made some new purchases over the past few weeks that I’ve been meaning to detail. New Positions 1. Red Hat Software (RHT) Red Hat is a distributor of open-source Linux operating systems. Open-source means that the…

The Merger & Acquisition (M&A) Train Keeps on Rolling…

This morning it was announced that another company we own is being taken over: Precision Castparts (PCP) is being bought by Berkshire Hathaway (Warren Buffett) in a ~$37 billion deal. Shareholders will be paid $235/share (a 21% premium to Friday’s closing price) in cash when the deal closes in the first quarter of 2016. PCP…

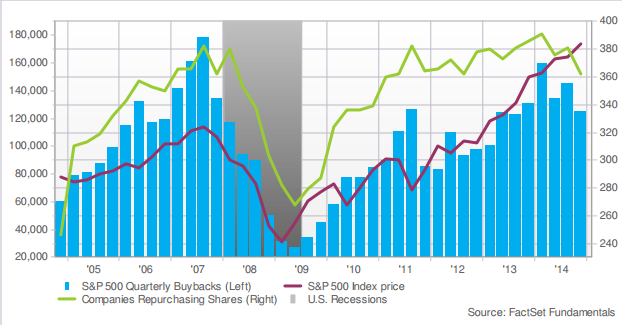

Are stock buybacks good or bad?

As with almost everything in finance, the answer is that it depends. Buybacks have been receiving a lot of criticism lately in the financial media. The most common complaint I here is that companies are only growing earnings per share year-over-year because they’re reducing the outstanding number of shares and not making investments in the…

Where Many People Go Wrong When Buying Stocks

Have you ever felt like you were missing out on a stock that was rising and wanted to buy it? Or worse, after watching it go up for a few days or even a few weeks in a row, couldn’t take it anymore and decided to actually buy it before it went up even more? …

The True Value of an Advisor/Investment Manager

There was news this week that Warren Buffett, famed manager of Berkshire Hathaway, did not beat the S&P 500 on a 5-year rolling basis for the first time in his career. Does this mean that he did a poor job and failed? He would probably say that he did because his stated benchmark goal has…