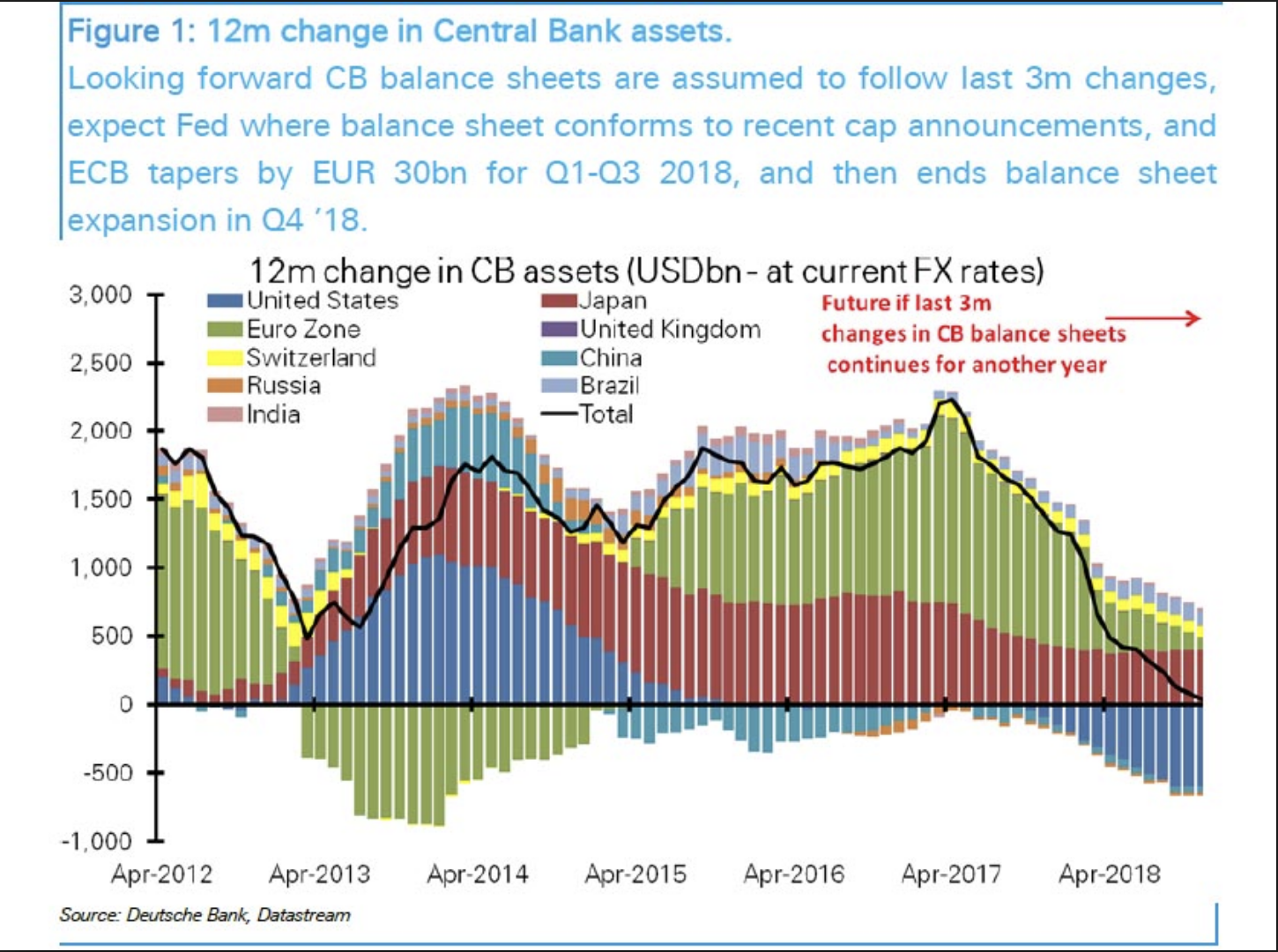

I’ve been seeing warning signals since the spring that we’re in the later stages of this economic cycle so I wanted to post an update to illustrate. One thing to mention is that cycles tend to move very slowly which can be a double-edged sword. It’s nice because you can typically read the tea leaves…

The Fed, Curve Inversion & Conflicting Signals

The Federal Reserve raised the target range for the effective federal funds rates (EFF) again last week, now up to a range of 1.75% – 2.00%. They also raised the rate they pay banks interest on excess reserves (IOER) by 0.20%. With this bump, I wanted to see the print for the average bank prime…

Recent Updates – Insurance, Biotechs, Dividends and Rates

Here are some recent updates from this month, including some new investments and some thoughts on how the market is setting up in terms of the economic outlook, interest rates and higher yielding (dividend) stocks. New Investment – Chubb Limited (CB) Insurance is an interesting industry in which to invest. When run properly, it can…

Yields & Income Investment Updates

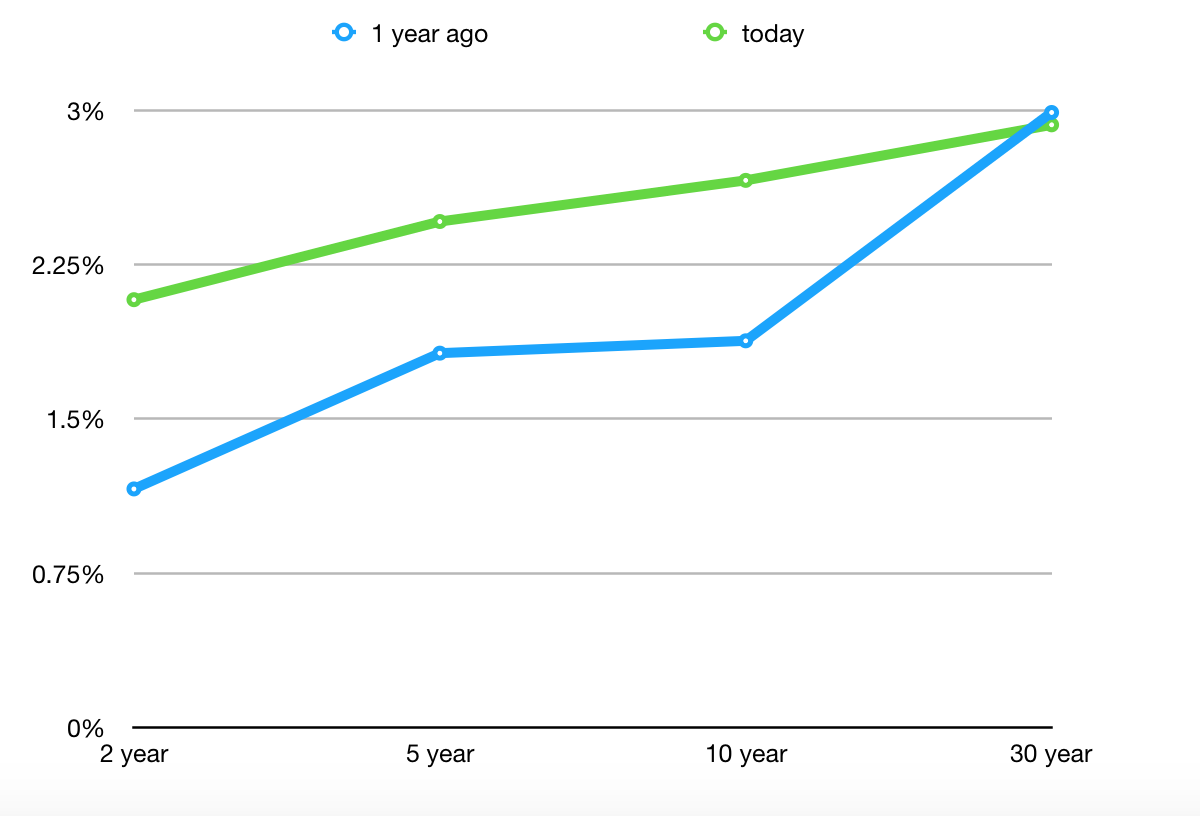

The 10-year Treasury yield stopped just short of 3% last week and the recent Commitment of Trader’s data is showing massive short exposure to the 10-year futures contract by non-commercial traders. These are speculative positions betting that the 10-year yield will continue to rise (bond prices will continue to fall). The market has a funny…

Rising Yields are Creating an Opportunity for Income Focused Investors

With stocks continuing to climb higher I’ve been a lot less active in terms of buying, especially on the Growth side of portfolios. However, there are some attractive opportunities popping up in the Income arena due to rising short and intermediate term bond yields. The yield curve is a line that measures yields at each…

How Systematic Investment Management Can Improve Returns

I made the decision this week to switch half of our Income Allocation within portfolios to a systematic management system. As I mentioned last week, I’m not totally sold that interest rates have bottomed but there’s a strong chance that they have, marking the end of the 35 year bull market in bonds. If rates…

Reducing Risk Exposure

I use a few different risk management systems to help in determining when to reduce exposure to higher risk investments like stocks and high yield bonds. These take into consideration economic data, market data (i.e. bond spreads, market breadth, etc.) and technical charting for trend strength. Monday was the last day of October and the…

Update on Quarterly Earnings Season & the Election

We’re in the heart of companies reporting their Q3 earnings and it’s been a bit of a mixed bag. There are a handful of small pockets doing well (cloud related services, electronic payments, cybersecurity, etc.) but overall I would sum it up as stagnant. The consumer is hurting from rising costs like healthcare while incomes…