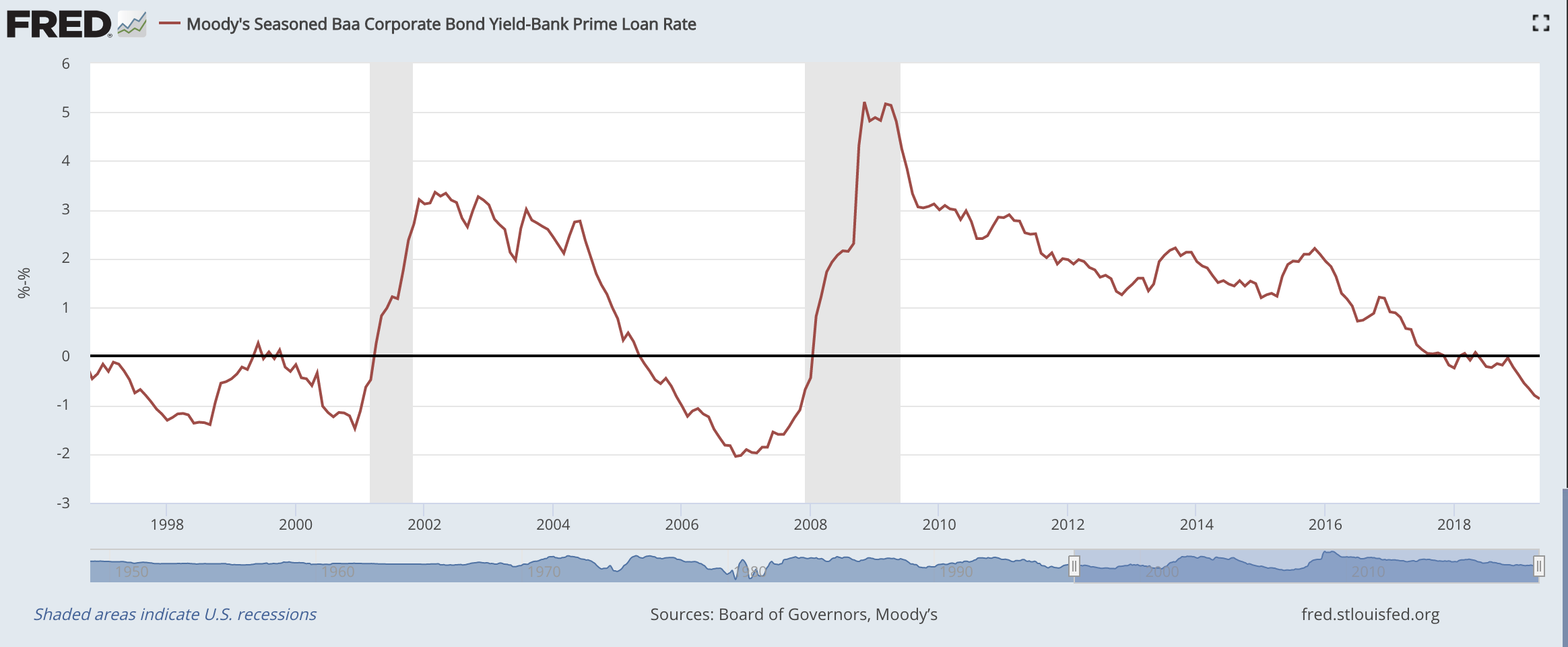

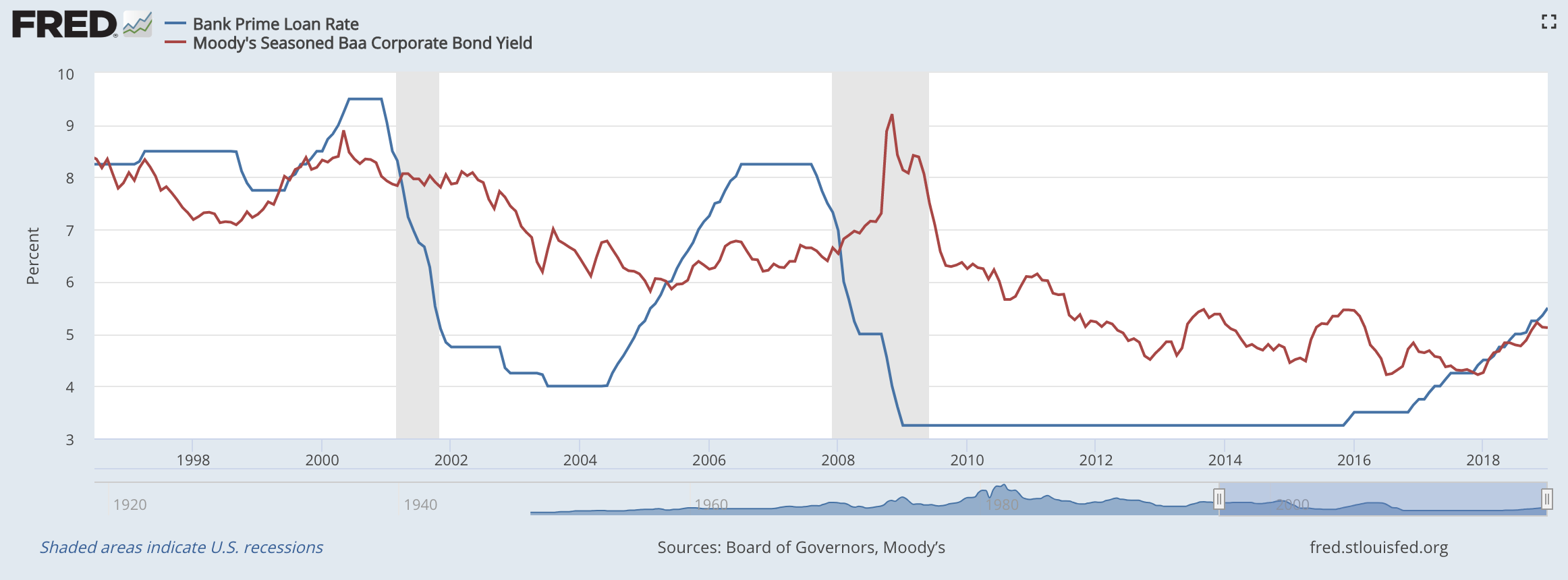

Last week the Fed cuts interest rates for the first time since the GFC a decade ago and the market’s response was pretty interesting. After referencing the 1995/96 one-and-done cut that prolonged the 90’s expansion all summer, I think they were hoping that they could get away with one cut as “insurance” that would ease…

Macro Update: Stocks, Bonds, and the Dollar – One is Wrong

For most of this spring, I’ve been telling clients that I’ve been in “wait and see” mode. The US dollar, bonds and stocks have all been rallying this year, and while that can happen in the short-term, the dynamics of the market say that can’t last in the long run. Basically, 1 of the 3…

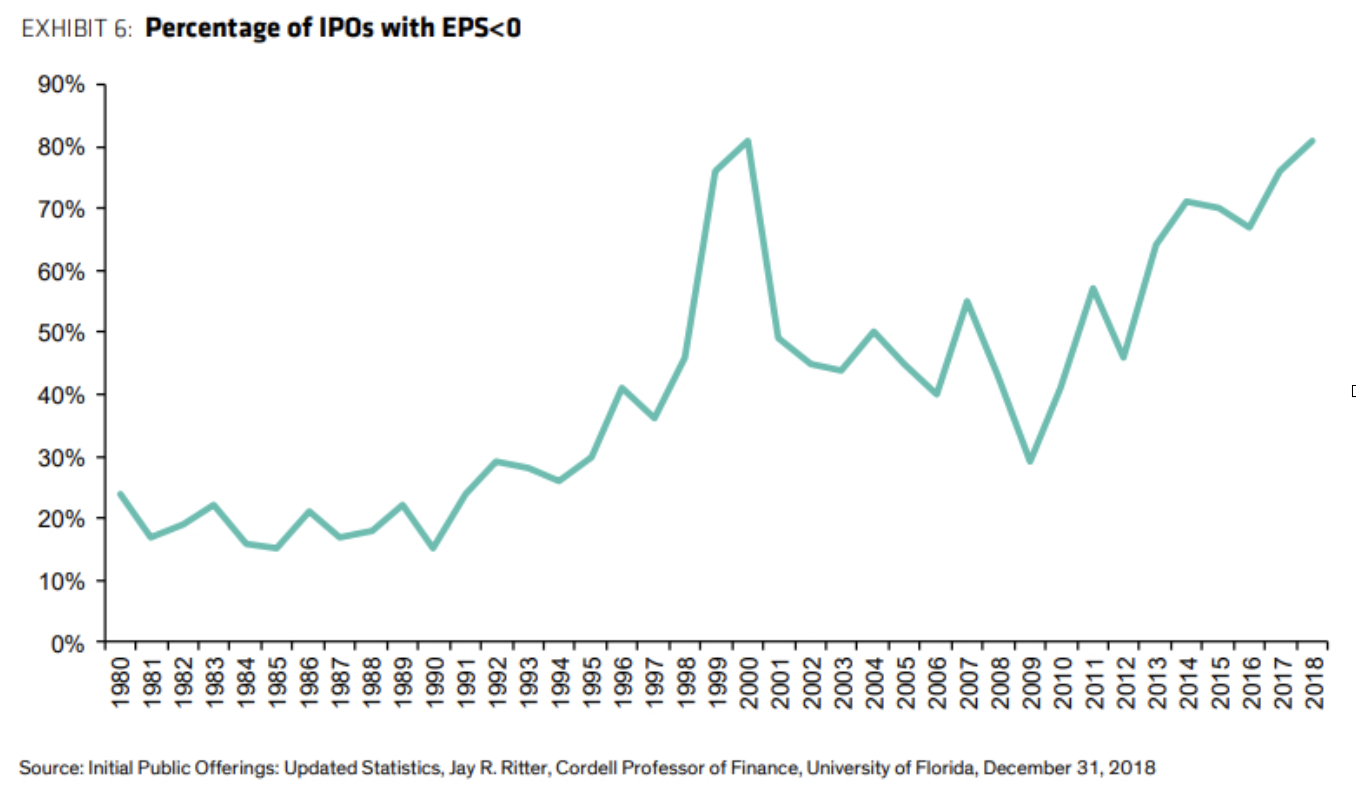

What’s Catching my Eye: IPOs & Fed Policy Change

Two things have jumped out at me over the past few weeks that have larger investment implications. First, the number of large IPOs (namely various tech companies) and second, some new messages from the Fed. I’ll touch on the Initial Public Offerings (IPOs) first. A slew of pretty large tech companies have been racing to…

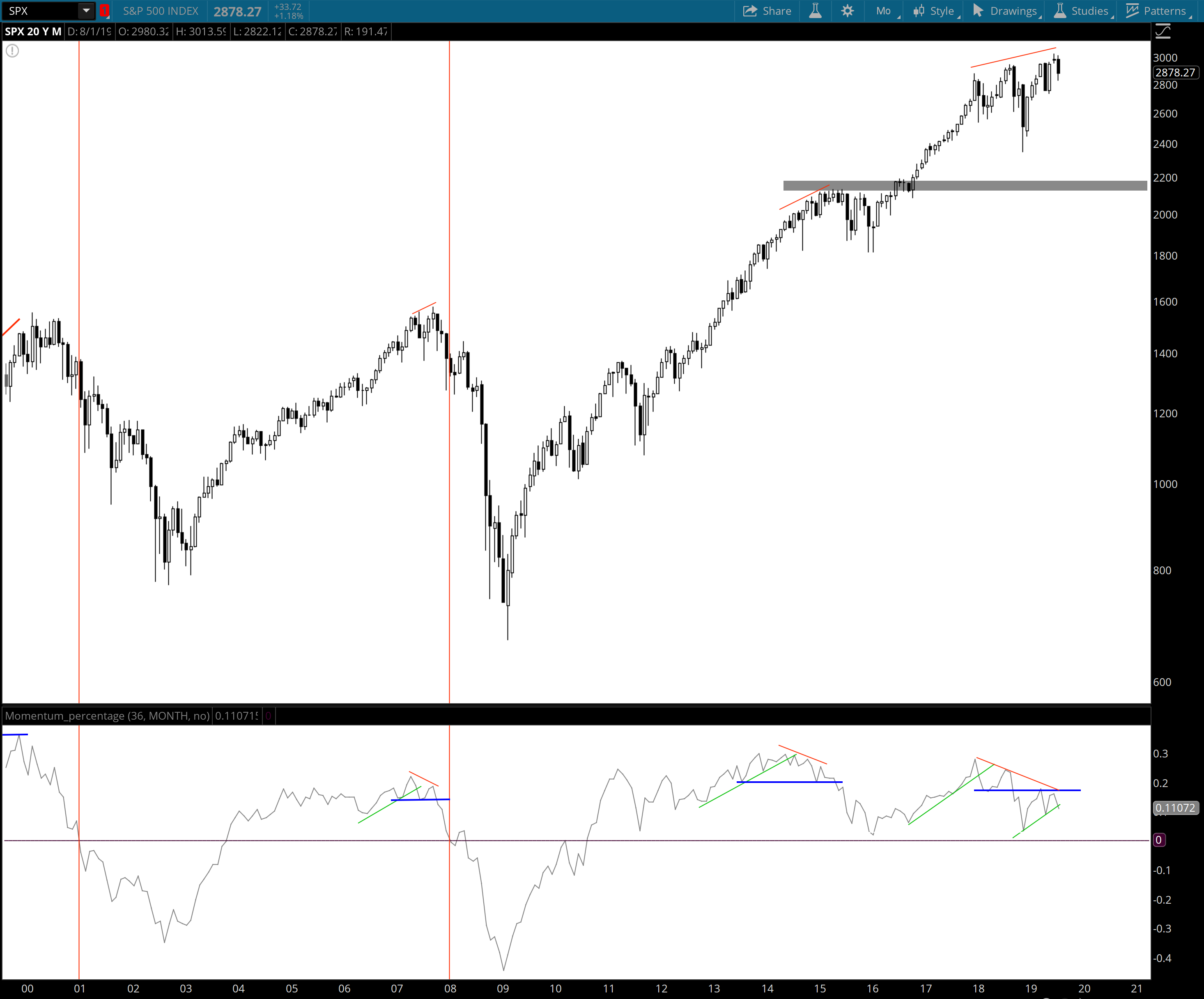

Macro Update

Unsurprisingly, the Fed finally got the message from the markets and pulled a hard 180 last month. In a very short six weeks, they went from “balance sheet runoff on autopilot and more rate increases to come in 2019” to “we’re pausing rate increases and we’ll be flexible with the balance sheet.” Risk assets have…

The Value of Scarcity

I very much value scarce and unique investments. One of the first economic lessons we tend to learn as kids is that the more rare something is, the more it is worth. This is something you probably learned quickly if you ever collected or traded something like baseball cards when you were younger. These are…

A Few Thoughts on Recent Events

Here’s my brain dump on the recent market action and how I’m approaching things: Since stocks started to slide in October, I’ve been seeing signals that only appear during bear markets so I’ve been operating under that assumption by reducing exposure to higher risk assets (stocks, corporate bonds, etc.) on bounces. We’re now…

How to Improve your Long-Term Investment Returns

Is this recent volatility in the stock market bothering you? I have a simple solution for you. Just stop looking at it! One of the most common traits that the vast majority of us share is that a loss of something hurts more than the equivalent gain (in our case it will be money). This…

Finding Long-Term Opportunities in the Short-Term Weakness

As I’ve commented on a few times this summer, rising interest rates and a flatter yield curve have been applying pressure on the economy. One area in particular that has seen a fairly strong slowing is the housing market, with home builders and related housing stocks down significantly from their highs earlier this year. I…