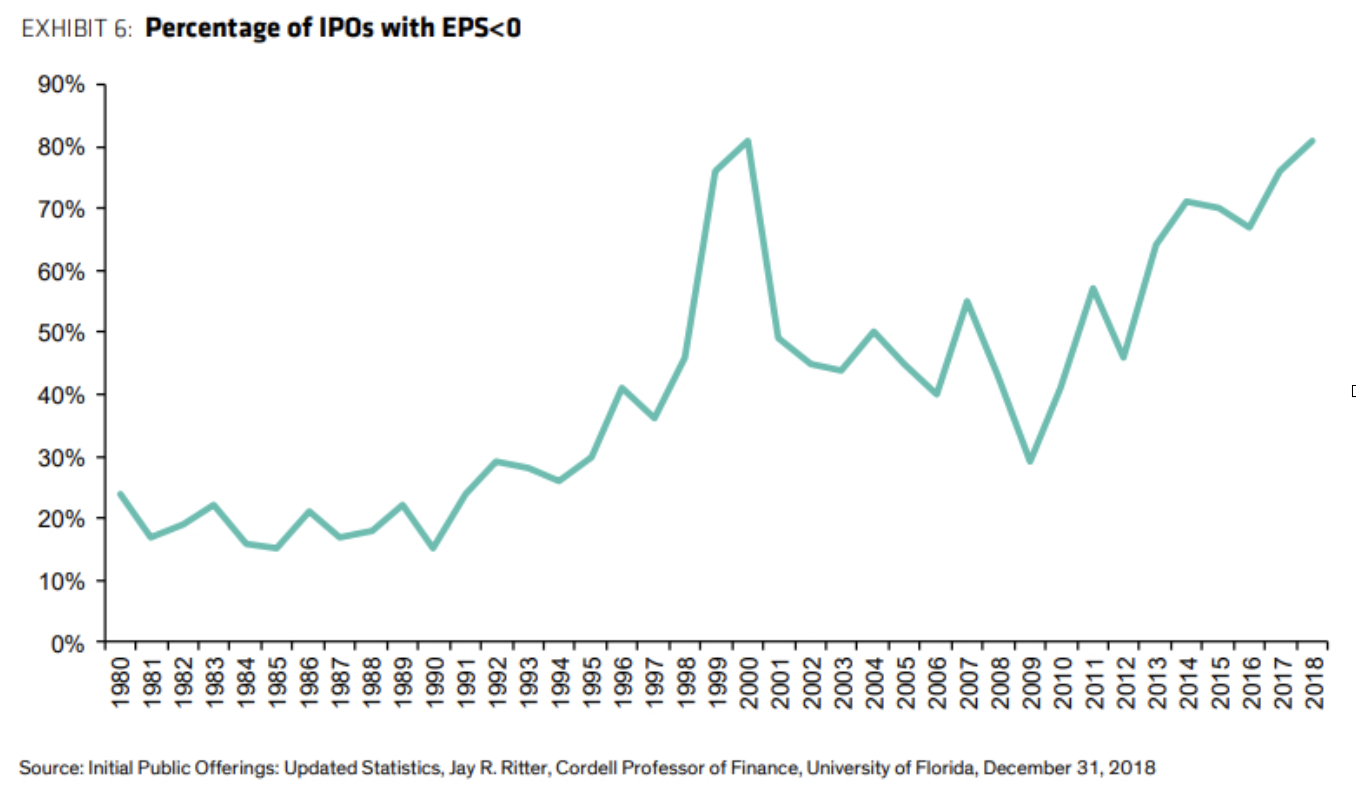

Two things have jumped out at me over the past few weeks that have larger investment implications. First, the number of large IPOs (namely various tech companies) and second, some new messages from the Fed. I’ll touch on the Initial Public Offerings (IPOs) first. A slew of pretty large tech companies have been racing to…

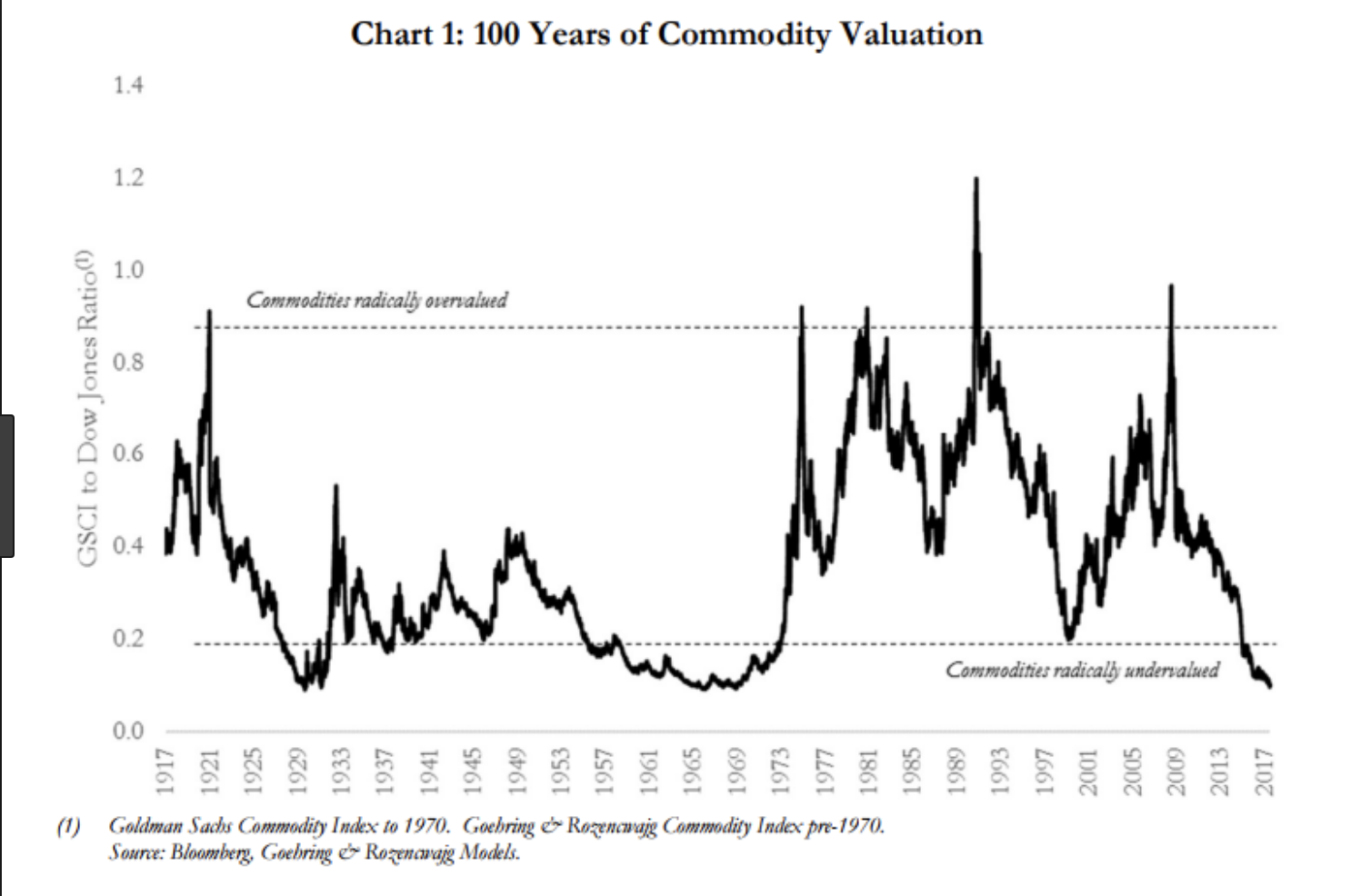

It’s All Connected – Why Gold is Starting to Shine

If you don’t own gold, you know neither history nor economics. -Ray Dalio I haven’t written anything in a little while because, well, there hasn’t been a whole lot going on to write about. We have had the usual Fed go full-panic-dove-mode, we’ve reportedly made progress on a trade deal with China about 28 times…

Macro Update

Unsurprisingly, the Fed finally got the message from the markets and pulled a hard 180 last month. In a very short six weeks, they went from “balance sheet runoff on autopilot and more rate increases to come in 2019” to “we’re pausing rate increases and we’ll be flexible with the balance sheet.” Risk assets have…

A Few Thoughts on Recent Events

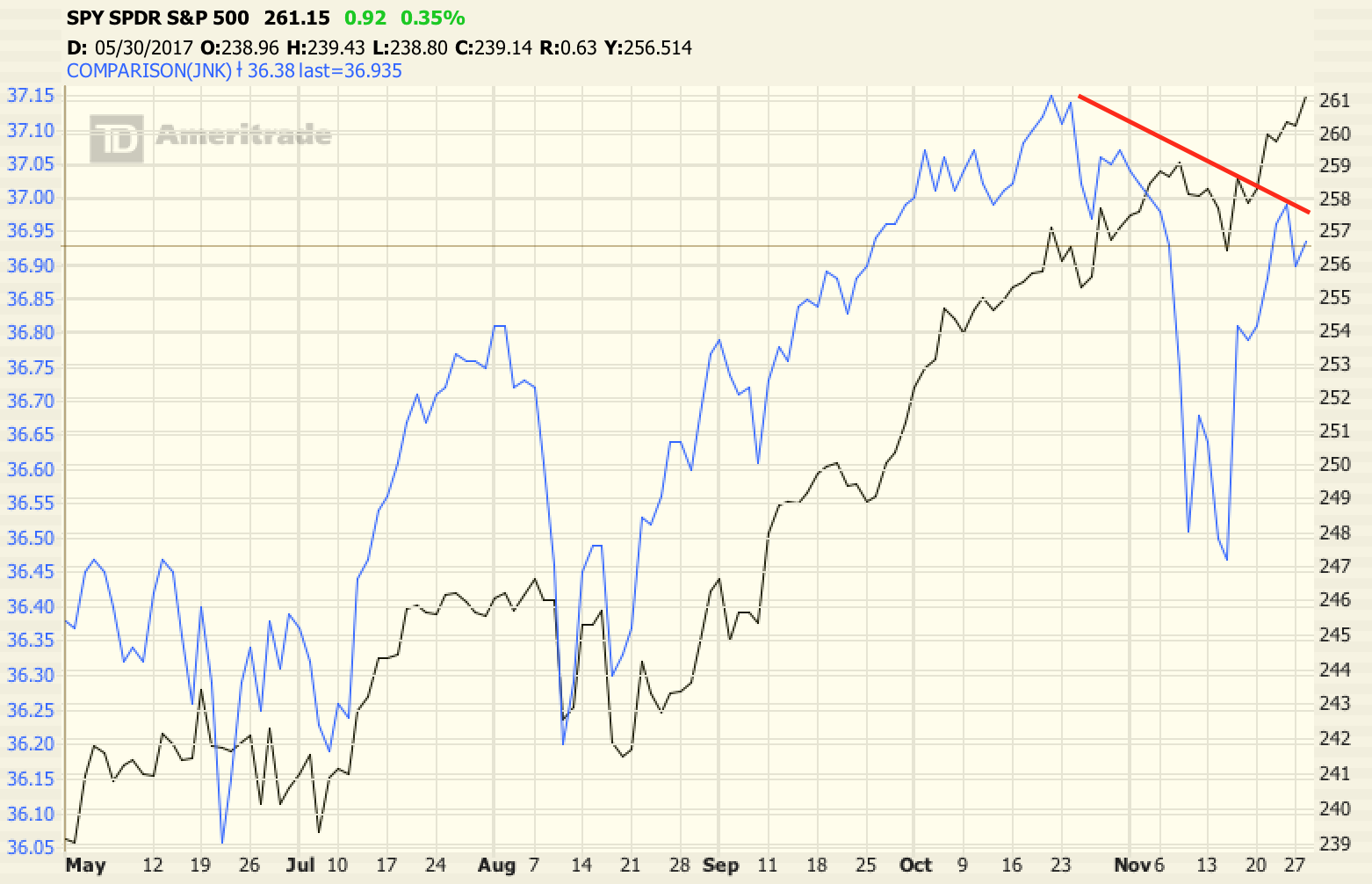

Here’s my brain dump on the recent market action and how I’m approaching things: Since stocks started to slide in October, I’ve been seeing signals that only appear during bear markets so I’ve been operating under that assumption by reducing exposure to higher risk assets (stocks, corporate bonds, etc.) on bounces. We’re now…

The Fed, Curve Inversion & Conflicting Signals

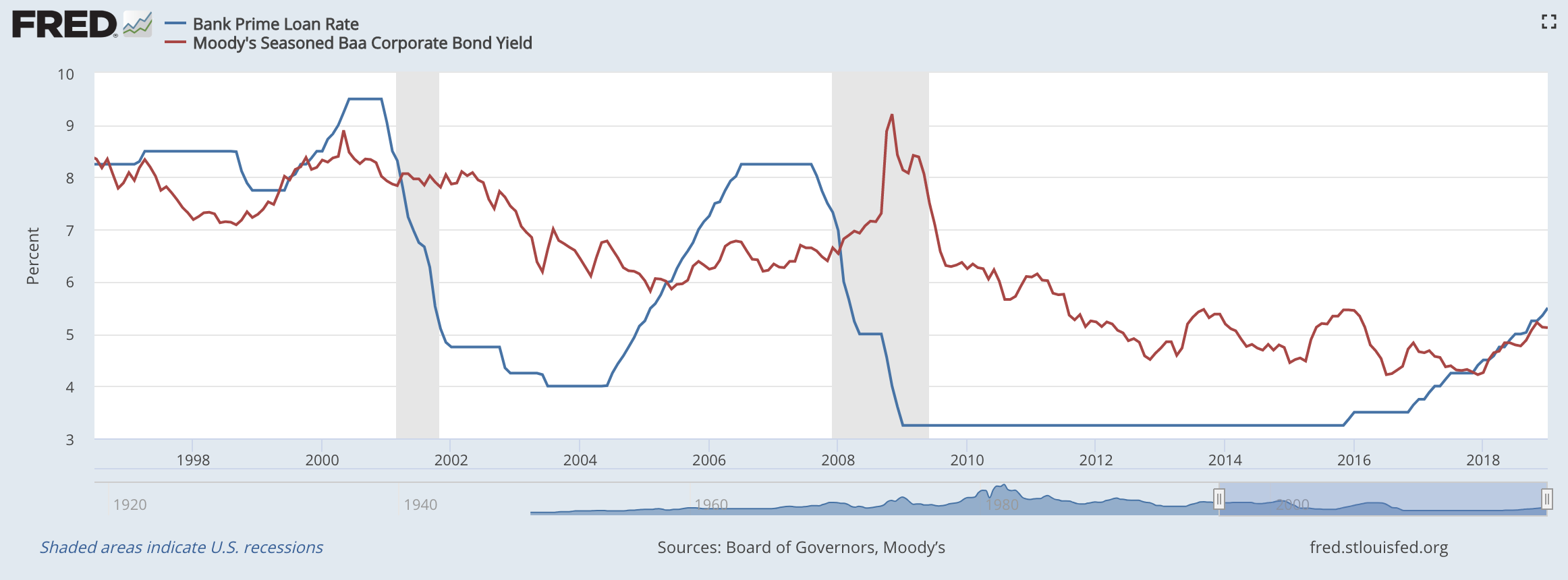

The Federal Reserve raised the target range for the effective federal funds rates (EFF) again last week, now up to a range of 1.75% – 2.00%. They also raised the rate they pay banks interest on excess reserves (IOER) by 0.20%. With this bump, I wanted to see the print for the average bank prime…

GE, a Lesson on the Perils of Debt and the Current Market Environment

GE, Debt and Dividends A few weeks ago General Electric (GE) announced that they were cutting their dividend in half in order to preserve cash flow. The last two times GE cuts it dividend were 1929 and 2008. That says something about the state of the economy. The stock market is by no means a…

Impact of the Presidential Election: The 2nd Domino has Fallen

I know this was a very emotional election so, as always, I preface this post by saying that my comments are purely from an objective point of view regarding the impact on the economy and investment markets. I realize there are many other very important social ramifications beyond just finance but I’ll leave those topics…

Adapting Portfolio Construction – 2 Updates

I’ve been thinking a lot lately about portfolio construction, especially for retirees, in these computer-algorithm dominated investment markets which swing wildly every time someone from the Fed speaks. Markets today are unbelievably short-term focused and my clients aren’t paying me to day-trade their retirement portfolios. This means that portfolios which are built with a long-term…